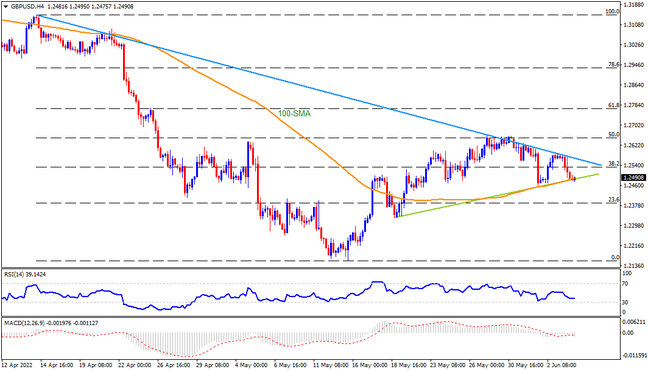

GBPUSD bears attack 1.2480 support confluence

GBPUSD not only snapped a two-week uptrend by the end of Friday but also jostles with short-term key support around 1.2480, comprising 100-SMA and a fortnight-long support line. Descending RSI and sluggish MACD also suggest that the bulls ran out of steam, suggesting further downside ahead. Hence, bears appear hopeful of revisiting the 23.6% Fibonacci retracement of the April-May downside, around 1.2385, with the immediate battle to be won against 1.2480. Following that, 1.2330 and 1.2260 may entertain sellers before directing them to May’s low of 1.2155.

Any corrective pullback, however, needs validation from a downward sloping trend line from mid-April, surrounding 1.2600 by the press time. Also acting as an upward filter is May’s peak of 1.2666, as well as the 61.8% Fibonacci retracement level of 1.2770. In a case where GBPUSD buyers remain dominant past 1.2770, an upward trajectory towards April 19 swing low close to 1.2980 can’t be ruled out.

Overall, GBPUSD signals further downside but sustained trading below 1.2480 becomes necessary.