GBPUSD braces for fresh 2022 low with eyes on Fed, BOE

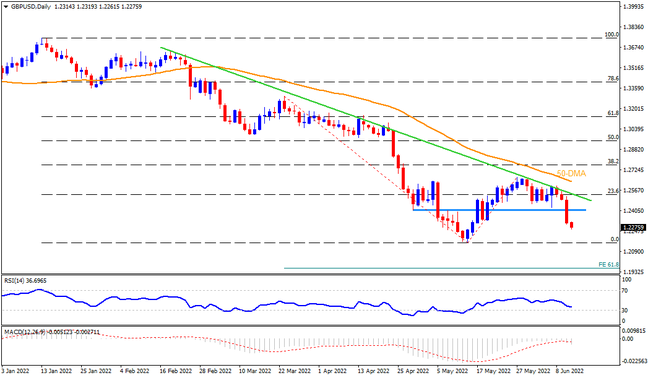

A clear downside break of the six-week-old horizontal support keeps GBPUSD bears hopeful of further south-run ahead of the US Federal Reserve (Fed) and the Bank of England (BOE) monetary policy meetings. That said, 1.2255-50 appears immediate support for the cable ahead of the yearly low surrounding 1.2150. It’s worth noting, however, that the quote’s sustained downturn past 1.2160 could make it vulnerable to further declines toward the 1.2000 psychological magnet. Following that, the 61.8% Fibonacci Expansion (FE) of late March to May moves, near 1.1950, might lure the bears.

Alternatively, recovery remains elusive until the quote remains below the recently broke support-turned-resistance, around 1.2400-2410. Even if the GBPUSD prices rise beyond 1.2410, a downward sloping trend line from February and the 50-DMA, respectively near 1.2570 and 1.2640, will be in focus. It’s worth mentioning that the pair’s successful run-up beyond the 50-DMA needs validation from May’s high near 1.2665 to convince the buyers.

Overall, GBPUSD is ready to extend the latest downward trajectory but the oscillators may test the bears and so do the central bankers. Hence, traders’ discretion appears more required.