Gold wavers around the last defense for bears ahead of US NFP

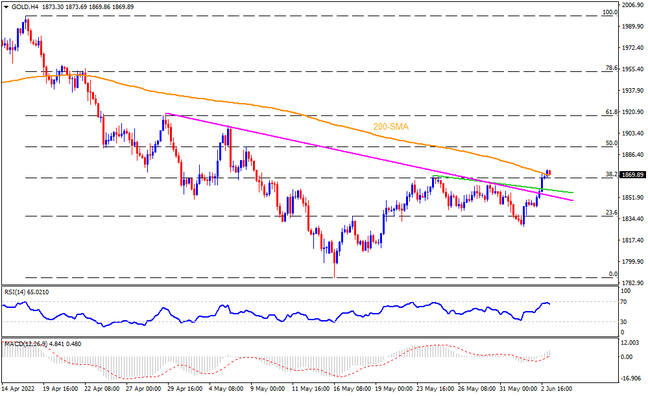

Gold prices seesaw around the monthly top after crossing a five-week-old resistance line, as well as a weekly hurdle. The recently bullish MACD signals and firmer RSI also favor the buyers as they attack the 200-SMA level surrounding $1,872, the last defense for bears. Should the US Nonfarm Payrolls (NFP) manage to propel the quote beyond $1,872, an upward trajectory towards the $1,900 threshold can’t be ruled out. Following that, the late April swing high and 61.8% Fibonacci retracement of the April-May downturn, near $1,920, should gain the market’s attention.

On the contrary, strong NFP prints could weigh on the gold prices and drag it back below the resistance-turned-support around $1,853. In that case, the 23.6% Fibonacci retracement level and the latest swing low, respectively near $1,835 and $1,828, could lure the gold bears. It’s worth noting that the precious metal’s downside past $1,828 won’t hesitate to break the $1,800 threshold before targeting May’s bottom of $1,786.

Overall, gold prices are likely to rise further as global markets await the US employment data for May.