Gold’s recovery is on a test around mid-$1,800s

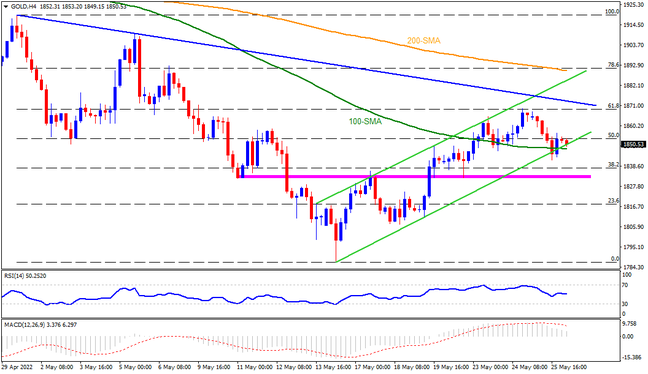

Gold prices stay pressured inside a fortnight-old bullish channel, recently challenging the channel’s lower line. Given the metal’s pullback from a monthly resistance line, coupled with the descending RSI, gold is likely to witness fresh selling. However, a clear downside break of the stated channel’s support, close to $1,845 by the press time, becomes necessary for the bear’s return. Also acting as an important downside barrier is a horizontal area comprising multiple levels marked since May 11, around $1,830. In a case where the bullion sellers manage to conquer the $1,830 support, the odds favoring a further downside targeting the monthly low of $1,786 can’t be ruled out.

Meanwhile, the aforementioned resistance line from late April, surrounding $1,865, guards the quote’s recovery moves. Following that, 61.8% Fibonacci retracement of a one-month fall from April 29 and the stated channel’s upper line, respectively around $1,870 and $1,888, could challenge the gold buyers. Should the precious metal rise past-$1,888, a convergence of the 78.6% Fibo and the 200-SMA, close to $1,892, will act as the last defense for the sellers before recalling the $1,900 threshold on the chart.