NZDUSD bears keep reins ahead of RBNZ again lift rates

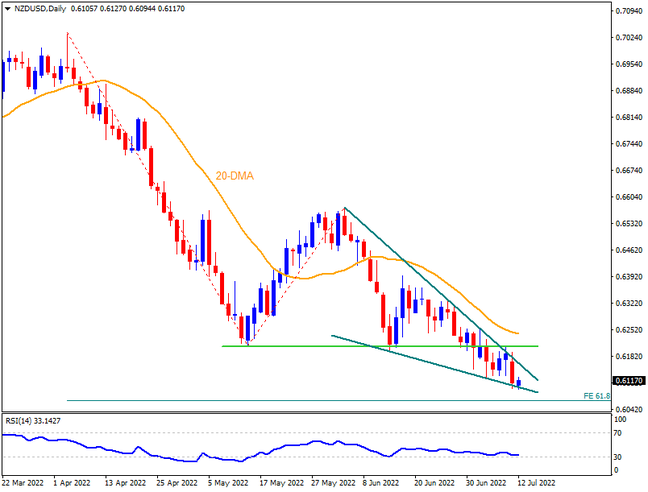

Having reversed from a two-month-old support-turned-resistance, NZDUSD stays inside a monthly falling wedge bullish chart pattern ahead of the Reserve Bank of New Zealand’s (RBNZ) third consecutive rate hike. RSI conditions and a falling wedge at multi-month low tease sellers ahead of the key event for the Kiwi pair. However, the 61.8% Fibonacci Expansion (FE) of April-June moves, near 0.6060, can test the sellers before directing them to the 0.6000 psychological magnet. That said, the support line of the stated wedge, close to 0.6100, could serve as immediate support to watch during the quote’s further weakness.

On the contrary, the NZDUSD rebound needs to cross the wedge’s upper line, around 0.6170 by the press time, to confirm the bullish chart pattern. Even so, horizontal support from early May, close to 0.6210, may challenge the buyers. Also acting as a short-term upside hurdle is the 20-DMA level surrounding 0.6250. In a case where NZDUSD rises past 0.6250, the odds of its run-up to mid-June swing high near 0.6400 can’t be ruled out.

NZDUSD is likely to rebound from the 26-month low but the recovery moves have multiple barriers to the north.