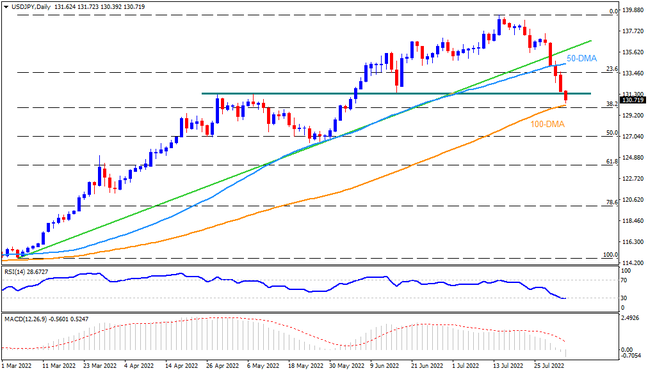

USDJPY bears battle with key supports

USDJPY renews its six-week low while extending the downside break of a five-month-old ascending trend line, as well as the 50-DMA. However, the pair’s further declines appear less convincing as the nearly oversold RSI and proximity to the horizontal support zone from late April, around 131.50-25 challenge the bears. Even if the quote drops below 131.25, a convergence of the 38.2% Fibonacci retracement (Fibo.) of March-July upside and the 100-DMA, around 130.00, could act as an additional filter to the south. It’s worth noting that the pair’s sustained south-run below 130.00 could make it vulnerable to drop towards the 50% Fibo. level surrounding 127.00.

Meanwhile, recovery moves might initially aim for the 50-DMA hurdle close to 134.35. Following that, the previous support line from March, around 135.80, could challenge the USDJPY buyers. In a case where the bulls keep reins past 135.80, the 137.00 mark appears the intermediate halt before challenging the recent multi-month high near 139.40 and the 140.00 psychological magnet.

Overall, USDJPY bears seem to run out of steam as they’re close to important support levels.