Forex Trading Sessions

To begin, most of you will probably already know that the forex market is open 24 hours a day, 5 days a week. However, it is important to consider the fact that forex trading activity is not always going to be consistently high or low during this entire period.

Therefore, traders need to memorize the key trading times (whereby the highest volume of trades are occurring, as well as opportunities to capitalize on increased market volatility) and make sure that their trading is in sync with those periods, in order to have a greater chance of making a profit.

Forex trading experts typically recommend that traders who are new to the forex markets should first consider opening up free demo accounts with a trusted broker to practice and experience trading within a simulated trading environment, where they will not lose any money.

up to 200%

from 0 pips

Trading platform

By doing so, traders can gain a better understanding of what to expect, and what to avoid (e.g. common forex mistakes) before they enter the live markets and risk their capital.

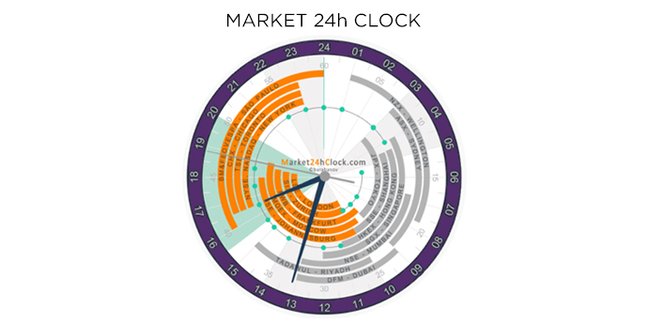

Forex Trading Sessions Clock

(CLICKABLE)

Forex Exchanges

The four main forex exchanges include: New York, Sydney, Tokyo, and London. Forex traders need to remember when all of the sessions start and end (according to time zones) and make sure to take advantage of the points where exchanges overlap (when one exchange is beginning to close, and another has just opened).

When these overlaps occur, overall trading volume in the markets increases exponentially, and so too does volatility (which refers to how much and how quickly prices for currencies and equities fluctuate). These two factors are important points of interest for forex traders because they can potentially provide greater benefits.

This is due to the fact that while volatility in other markets (stock markets, bonds, crypto markets etc) is generally seen as a negative thing, and something to avoid, in the forex markets it can be a positive thing, due to the fact that higher volatility can pave the way to an increase in chances for payoffs.

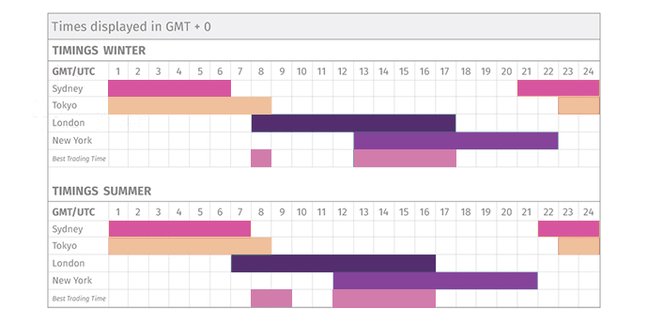

Forex Trading Sessions Chart

What Time Is Best To Trade Forex?

So what is the best time frame to day trade forex? Well, put simply, the best time to trade on the forex markets is at the point at which trading is at its most active levels. Traders will need to be closely monitoring the markets, aiming to capitalize and make the greatest amount of capital they can, at the point (time frame) where the money makers have already facilitated their currency trades.

Furthermore, during these periods the gap between ask prices and bid prices significantly lessens, thereby enabling traders to begin to potentially increase their capital.

The forex market has a total of 15 different exchanges around the world which are open between Monday-Friday. Every exchange differs in regards to its trading hours. The key time frames that forex traders need to pay attention to are:

- New York: 12 pm - 10 pm

- London: 7 am - 5 pm (afternoon)

- Tokyo: 11 pm - 9 am

- Sydney: 10 pm - 8 am (midnight)

Each exchange is operated independently, although they all allow traders to trade the same currencies. When two exchanges are open simultaneously, the amount of traders purchasing and selling currencies rapidly increases.

Therefore, the bid prices and ask prices within one particular forex exchange market, will also have an immediate effect on other exchanges that are open at the same time, and will affect their bid prices and ask prices as well. The following market times represent where this activity is most prevalent:

- 7 am to 9 am (whereby both the Tokyo and London exchanges are open)

- 11 pm - 7 am (whereby both the Tokyo and Sydney exchanges are open)

- 12 pm - 5 pm (afternoon) (whereby the New York and London exchanges are open)

Taking all of this into account, one could argue that the best time to trade forex is the 12 pm to 5 pm (afternoon) point of overlap between the Lndon and New York forex exchanges. Moreover, these two particular trading epicentres represent 50% or more of the total forex trades that occur within a given trading day.

In addition, the vast majority of trading occurs between 9 pm- 10 pm in the Sydney and Singapore forex exchange markets, and the volume of trades is significantly less than what you will find in the New York & London trading window.

Forex traders should also consider the fact that worldwide news developments can also have a significant impact on the markets in terms of price fluctuations, and the times at which people decide to trade.

For instance, these events could occur during a quieter trading window, and could lead to a significant rise in trading volume and market volatility, regardless of the usually quiet and slow trading period.

Traders should also understand that higher trading volumes do not always equate to profits. Currency traders typically have higher rates of leverage (between 1000 to 1), and while this particular ratio might sound like it promises a greater chance for making far higher profits, investors could stand to lose their whole investment within one trade.

Stay tuned! Also read about:

- Best Books about Forex if you are beginner;

- 7 Best Trading Movies.

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.