How does Forex Market Work?

Before you start to play any game, you learn the rules. If the victory is what you came for, you enter into every detail and master the strategies to get the strength. Beginners often lack knowledge of how Forex trading works, or if it works at all. Some traders start trading with wrong motives, unrealistic goals, greed or haste, they lack the effort so they fail consistently. This article will help traders to puzzle out the complicated picture of Foreign Exchange trading.

Main article section

- Supply and demand

- The map of the trading industry

- How things work on the international market

- Analysis for better performance

- Avoiding common trading mistakes

- How does Forex trading work from a practical standpoint?

- About Forex price quotes and liquidity

- Forex trading mechanics

Supply and demand: The carrot cake pattern

Supply refers to the number of goods that are available. Demand refers to how many people want those goods. When the supply of a product goes up, the price of a product goes down and demand for the product can rise because it costs less.

Imagine you're going to buy some carrots for the carrot cake on a gloomy Sunday. There is the only vendor in the area with the right amount of them. You bargain, agree on the price and exchange a set amount of money for a bunch of crunchy carrots. Customer and Vendor have got precisely what they've intended.

The next day the weather changes and there are two vendors with carrots. Supply today is higher, two vendors Vs one customer. The competition between vendors pushes the price down since both of them realize: you will probably buy cheaper ones assuming all other features are equal. A new price leads to a deal with one of the vendors.

Or alternatively, you are on a carrot hunt again: the dessert was so yummy, that your kids asked you to repeat. Your neighbour, who came over for a dessert, also did like the cake and now dies to buy carrots and make the carrot cake. The vendor seeing both of you hustling near carrot baskets increases the price knowing there's the only greengrocer's open this day.

Also, if one of the carrot vendors goes out of business this season, both you and your neighbour can expect the price of carrots to rise before you even show up at the greengrocer. This pattern illustrates the ABC of economics.

If we apply the carrot cake pattern to the Foreign Exchange market, we will see: every time a particular currency is bought, a surplus demand appears, pushing the price higher and ruining the balance. Otherwise, when the currency is sold, a surplus supply appears instead, pushing the price down.

The amount of impact depends on the trading volume per deal. Actually, it is directly proportionate. Significant players, like national banks, are able to cause a disequilibrium by interfering the supply of their home currency. Less significant players, like retail traders, can only influence the market so slightly, but still, manage to do it through their sheer numbers.

The permanently changing supply and demand balance is the driving power of Forex charts. The essence of price balancing is the key insight into how online Forex trading works since all economic events in the world are relevant to the market and affect the supply and demand formation of the asset.

The map of the trading industry

The Forex Market has a diversity of traders taking part in every interaction. Let's call them by categories.

- Giants (national banks, multinational companies, hedge funds). It is their monetary policy and trading decisions that have the greatest impact on the market, misbalancing prices the most.

- M-size companies (private investors, private banks, companies needing hedging)

- Small players (financial brokers, small banks and investors)

Most of the participants have direct access to the Forex Interbank because they are over a certain threshold of funds. Forex Interbank operates all the currency exchanges and participants can trade on this level with each other without middlemen engagement.

The purchasing power of a casual trader (that is probably where you are) is usually limited, and here goes a Forex Broker or a Bank providing a financially leveraged account and access to the market via trading services. A pure vision of the market flow should prevent you from fail and train a necessary caution for trading.

As you know now, it is not only the ability to analyze trends and estimate the risks that can make you a good trader but also patience, discipline, and consistency. There are enough books on how to not to crash on the pitfalls, and the main precaution is: don't get into the deep water if you are not a good swimmer yet. Here is a ring buoy, try deep water with MTrading support, a free demo account.

up to 200%

from 0 pips

Trading platform

How things work on the international market?

Forex market is for currencies, which act like economic tools and indicators. Indicators basically identify and measure the strength of the trend. If we imagine countries like companies, currencies are their stock. The monetary policy decisions of central banks and interest rates set by the national bank of every country in the world are a major influencing factor on the Forex market.

Who are the biggest players? They are the Federal Reserve Bank, the European Central Bank, the Bank of England, and the Bank of Japan since the US dollar (USD), the Euro (EUR), the British Pound (GBP), and the Japanese Yen (JPY) are the most traded currencies in the world.

When interest grows, borrowing currency from the bank becomes more expensive and it immediately causes a shortage in currency supply and the currency price increases. You may think it would be good for forming a strong national currency, but it isn't. Actually, it means there is less money to work for business development, lower expendable household income and ultimately a slower economic growth. Yet it holds up inflation rate and slows down the inevitable debt build-up – which, in the long term, is a very good thing.

Conversely, when the interest rate is cut, market participants can borrow more money. Thus a surplus money supply is created and the currency price goes down. Short term, this can lead to business expansions, increased household spendings, and a growing economy. And again, this criterion is two-sided: the more money is borrowed, the more is owed; the accumulated bank credit having the potential to create a financial crisis.

Analysis for better performance

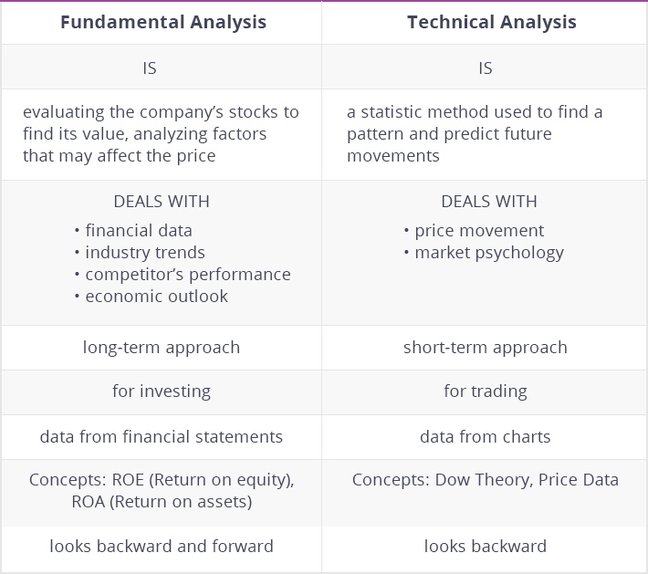

Analysis in trading is, to some extent, the only thing that makes FX trading really work. Let's shed some light on two major schools of analysis. Fundamental Analysis stands for economic research and predicting the future, whereas technical analysis is a price history and statistics display.

Avoiding common trading mistakes

It's been a wealth of text and if you are still reading, well done! You are on the right way to success. Now look, this is how usual fail on Forex market looks like, make sure you are not going to do anything like this:

A Forex Broker rookie begins with $10 hoping to make a fortune. He thinks Forex is like a flipping coin and firmly clicks wasting no time on education and safe practice. He believes in luck because Fortune favors the brave. Not in the finance market, unfortunately. On the Forex Exchange market, Fortune favors educated, and the market spits the rookie out, disappointed and full of anger. And this is how most of the negative feedbacks about Forex brokers appear.

How does Forex trading work from a practical standpoint?

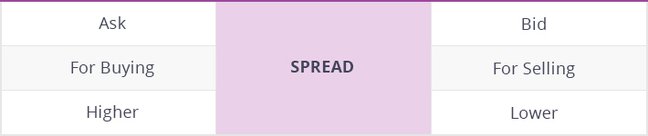

International currency exchange rates display the value and show how much one unit of a currency can be exchanged for another currency. It is called a price quote. Price quote consists of two prices: a bid price used for selling and an ask price used for buying. The bid is always lower, that's why you always sell your currency to the bank cheaper than you have bought. The difference between the bid and the ask is called the spread.

About Forex price quotes and liquidity

While the market works, bid and ask interact permanently. The broker receives price quotes from its liquidity providers - the banks and delivers them to the trader.

Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price.

The more liquidity, the tighter the spread. Usually, trading is going smoothly, and liquidity is plentiful. Sometimes, like during major news releases, the price gaps occur due to major price shifts over the shortest periods of time, which can provide both a big profit opportunity and a big danger of loss. Nothing ventured, nothing gained.

Forex trading mechanics

Once a trader has chosen the platform and placed a buy order on the EUR/USD currency pair, a portion of funds from the trader's account is used to purchase the pair's base currency (EUR) and sells the pair's quoted currency (USD).

The order is placed either with the broker (Market Maker) or communicated directly to the Forex interbank market (ECN execution), where the big players are. The trader can place an order to sell a currency that they do not 'own'. After that, the trader waits until the purchased currency grows in value compared to the sold one. The trader accumulates a satisfying profit and closes the order, the broker sells euros, buys dollars. Selling order takes the same process but in reverse.

For a beginner trader, it might be easier to think of a currency pair as an abstract financial instrument to which a price is assigned by the market.

Stay tuned! Follow the updates in our Education section.

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.