What Is Stop Loss and How to Set it Right

Every trader dreams of having an efficient Plan B that would limit his or her risks. A stop-loss order may turn out to be that anticipated exit plan that will eventually prevent you from losing money. The concept is pretty simple. Traders set an exit point at a certain price level protecting them from unexpected risks.

In truth, it is not that easy. For example, if you set it too far, you will inevitably suffer from huge losses. Setting the exit point too close means high chances of being kicked out of a position very fast. So, how to set a stop-loss order with minimum risks and maximum profit perspectives? Read the article to learn more about stop-loss strategies, setting methods, alternatives, and other crucial issues that are vital for both beginners and pro traders.

What Is Stop Loss Order?

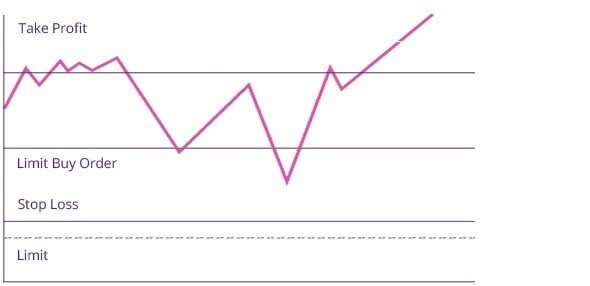

As you have understood from the introduction section, a stop-loss order is an entry point for traders who want to sell instruments as soon as they reach specific price levels. The main idea is to minimize potential losses and keep up with the most secure market positions. Below you can see a simple stop-loss illustration example, where stop loss is located under the current price and take profit level, preventing from losing money if the price reveses too much.

Usually traders are not ready to losing more than 10% of the initial asset price. So, you will probably would like to set the stop-loss order 10% below the existing price level to limit the potential loss by 10% only in case of negative price action.

Stop Loss Order Types

Of course, it would not be for trading if it was that simple. Before setting, you need to consider several stop loss order types and define which one meets your particular trading strategy.

- Market Orders – a stop loss market order is the most common type that applies to the price that reaches $19.50 either it is an ask, bid, or last price touch. However, if there is no one eager to buy the asset, a trader can end up at lower price level. The situation is also known as slippage. On the other hand, it will hardly happen in case you trade an asset at high volumes.

- Limit Orders – this stop-loss type acts in a different way. Once the price has reached a specific level, your broker automatically sends the limit order. It results in closing a position at a pre-defined price or even a better price.

Note: The difference here is that the first type closes the position at any price level while limit orders eliminate the negative consequences of slippage making the stop loss more effective and sometimes even profitable. In other words, trading with a trusted broker prevents you from price changes moving aggressively towards you.

up to 200%

from 0 pips

Trading platform

Things to Consider When Setting a Stop Loss

With all benefits delivered by stop-loss orders out of the box, they do not work for all traders the same way. For this reason, you need to consider the following issues:

- Active traders should avoid using stop loss orders.

- If you trade large blocks of stocks, a stop loss may result in bigger losses in the long run.

- Keep an eye on the broker's fees for different types of stop-loss orders.

Remember, the order has not gone through unless you have received the confirmation.

Methods How to Set a Stop Loss

As a beginner, you will probably use some common ways from the start. Those ways mainly refer to methods with percentages we have discussed a bit earlier. However, there are some more complicated methods that may include hard stops as well as specific actions on the market either you buy or sell assets. Let's have a closer look at techniques you may apply depending on your trading style.

Placing a Stop Loss When Buying

Always keep in mind, that stop-loss must never be placed randomly. At the same time, you are supposed to leave enough room for fluctuation. Just make sure it will get you out of the market and close the position once the situation has gone out of hand and the price has turned against you. When you buy an asset, the best way is to place a stop loss below a so-called swing low. The term refers to the price falling down and then bouncing.

If you feel that you are ready to try using stop-loss, open a demo account with us. It's free, it reflects real market conditions and it already has $5000 on balance to test in a risk-free environment. Another option is to copy deals of successful traders in real-time with the Copy Trade service which also makes your trading safer.

Placing a Stop Loss When Selling

If you decide to go short, act more the same way as when buying. Do not use a random level to place a stop loss. The only difference here is that the order must be set above the swing high. It will let you support the position once the price hits the bottom level. The technique will work for those who want to trade in the direction of the trend, while the price finds resistance at its upper level.

Stop Loss Order Alternatives

You should note that the examples above are not obligatory to follow. It is all about market flexibility and foreseeing. The mission was to show how stop-loss orders work within specific market conditions. Traders are free to choose alternative points to place the order depending on the entry asset price and some other factors.

For example, you may use technical indicators, which may appear to be a stop loss themselves. They provide a trader with a "go long" or buy signal, which means that an order can be set at the level where indicators will no longer provide signals. Volatility is also a wise decision to be used for setting stop-loss orders. Whatever you do, always keep up with a proactive re-entry strategy to keep your trading away from huge losses.

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.