Forex Trading Simulation Software

Best Forex simulator software

A Forex simulator is a trading software that simulates market conditions, creating an impression of a live trading session. The usual aspects of trading, such as opening, modifying, and closing orders, remain the same.

The key features of a Forex simulator are as follows: live simulation and market updates; risk-free demo-account trading; the inclusion of all trading features and functions; the ability to test any strategy.

Main article sections:

- How to know it's the best Forex simulator software

- A Forex strategy tester and day trading simulator

- Testing manual strategies with MTrading day trading simulator

- The key to successful paper trading

While a degree and strong analytical skills can certainly help you succeed in trading, they will do little good without live practice.

Some believe mastery requires 10,000 hours of practice. Generating success in trading will likely necessitate similar diligence.

At any rate, you don't want to lose money while getting the practise you need. Using Forex simulation software on a demo account lets you learn the ropes and avoid putting your hard-earned money at risk.

How to know it's the best Forex simulator software

There are two types of trading simulation software.

The first one uses a simple algorithm to mimic the broader market. The second one is a sophisticated trading platform, which offers a far more realistic market experience. While both can be useful, the latter provides much greater value. Let's review the most important factors involved in selecting the right trading software.

Ensure a real market environment

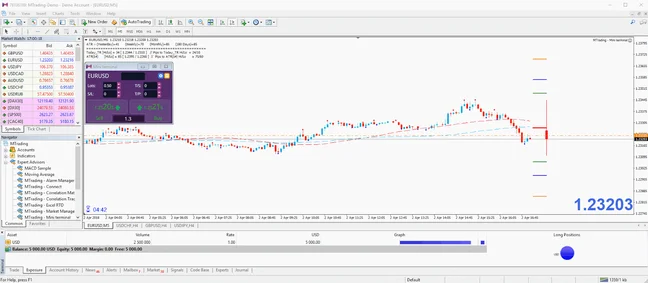

Source: MetaTrader4

Having a live pricing feed is crucial to Forex trading simulation software. This feature will provide you with real-time price data. Without this information, you will not be able to evaluate your trades effectively.

A flexible deposit amount

When you're ready to begin practising with a demo account, it's important to use a paper amount close to the sum you expect to use for live trading.

Practising trading with a demo account will:

- grant you the opportunity to learn more about the software platform;

- give you a chance to develop and test strategies.

up to 200%

from 0 pips

Trading platform

Remember that any strategy you use should incorporate stop-losses, take-profits, and margin levels.

An advanced trading platform

When you start trading with a demo account, it's important to work with a Forex simulator software that is sufficiently advanced.

If you just pick the most user-friendly platform, you may need to upgrade later due to the issue of missing features. Starting out with an advanced platform like the MetaTrader 4 Supreme Edition may save you time in the long run. Also, please keep in mind that if you don't want to day-trade, an advanced platform is not as vital. Fortunately, MTrading has developed special software in cooperation with FXblue that is a part of MT4SE.

Whether you want minimalist software or a powerful tool, your trading simulator allows you to manually test your trading strategies based on historical data and analyses of the results.

Source: MetaTrader4

One additional way to find a good Forex or a CFD trading simulator is to search for one with a flxible backtesting feature.

The MT4SE platform offers the best day trading simulator which allows you to backtest manual strategies with historical data. This trading simulator can test various strategies under different time frames.

Find popular strategies and try them out. You never know how effective these strategies will be until you try them.

Source: MetaTrader4

A Forex strategy tester and day trading simulator

We will start with the strategy tester first. This is our best CFD simulator for simulated CFD trading.

Once you've installed the MT4SE platform, you can start by pressing Ctrl+R or clicking the button as shown in the example below. You need to select the preferred time frame window and make sure that you have enough historical data loaded. It is recommended that you properly adjust your account balance to match your live account.

How Long Should One Use Forex Trading Simulator Software?

At some point, one will realize it is time to move to a real account. In fact, the main idea of trading simulators is to prepare a novice investor to enter the real market and open positions with real money. The main problem here is that some beginners cannot identify the point when they are ready to invest real money.

Some novice traders open real accounts as soon as they gain success with simulators. However, losing is a natural part of trading. If you are not used to it, you will fail both financially and emotionally with no chance to recover.

The average time rookies should spend with Forex trading simulator software varies from 1 to 3 months. This period is enough to establish a foundation that will let you make some net gains. On the other hand, if you constantly lose money even on a demo account, you might need to change tactics and run it with zero risk until it becomes successful.

Another important thing about using simulators for quite a long time is finding a preferred and efficient trading method. If you find the strategy that works well on a simulator, you can move to a real account and use it under real-market conditions. After all, your main mission is to make the percentage of winning trades as high as possible.

Last but not least, traders must establish a minimum amount of payouts they want to get per month before opening a real account. In simpler words, if you managed to earn around $300 per month on a simulator, it is very unlikely you will get $2,000 monthly on a real account. So, be as realistic as possible and consider potential losses.

As soon as you achieve all of the above-mentioned milestones, you can start investing real money.

Trading Simulators for Carry Trade Strategy Planning

The ability to plan carry trade strategies is another reason to use Forex simulators. One can actually execute carry trades under real conditions with zero risk. All you need is to follow several simple steps:

- Monitor central banks’ interest rates,

- Group at least currency pairs together. Compose one asset with high-yield currency and another instrument with a low-yielding one.

- Use the software’s time control mechanism to see the historical data to see those carry trades 1 year ago.

- Compare the performance with current data and make proper decisions.

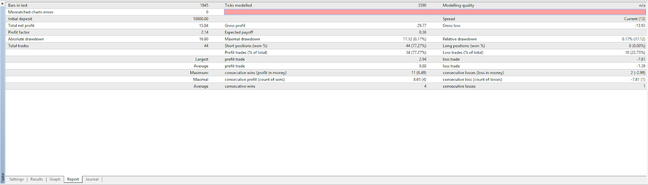

Once completed, click the Start button. You can use whatever template you want, and the platform will allow you to simulate (approximately) the last four months of trading (01.01.2018- 04.02.2018).

To ensure the maximum compromise between speed and quality, apply these settings:

- Model: Open prices or Every tick;

- Visual mode: Checked (to ensure visual backtesting data);

- Period: Select a period that matches your trading strategy;

- Spread: Current.

Testing tips:

- The slider that is visible just after the visual mode option allows you to speed up or slow down the visual backtesting process.

- If you use the Every tick model to test your Forex strategy, please bear in mind that it might take a really long time to finish backtesting.

- Every tick should be the most accurate, but also the slowest one.

- Backtest and backtest again – until you finally find profitable settings.

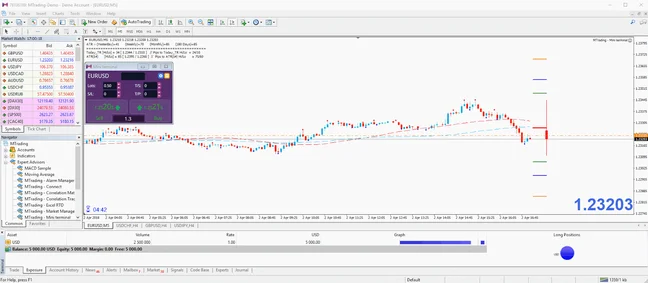

Source: MetaTrader4

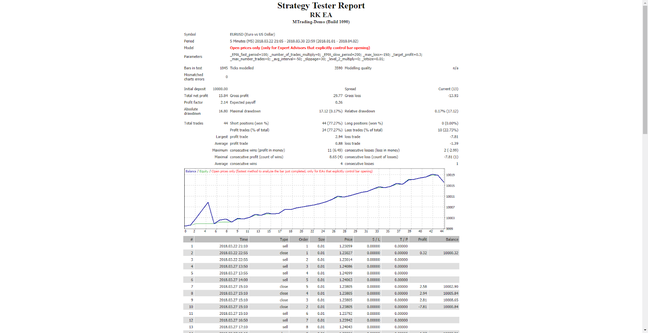

Once finished with a visual backtest, click the Results or Report tab and view the result. In the example below, we can see that the Master Candle strategy has produced approximately 6.72% ROI (Return On Investment) during the tested period. That's much better than what the banks offer you, right?

Source: MTrading Strategy Tester, MT4SE

After you finish with testing, you will be able to publish and print the result.

Source: MTrading Strategy Tester (Personal), MT4SE

Testing manual strategies with MTrading day trading simulator

Day trading simulation lets you place market and pending orders, set trailing stops, alter the s/l and t/p on orders by clicking on the chart, save complex order definitions as templates, quickly close all open orders, and access many more features that are not available as standard in MetaTrader 4.

One of the best things you can do with our strategy tester is use historical data to test manual trading strategies. Here's how you can do it:

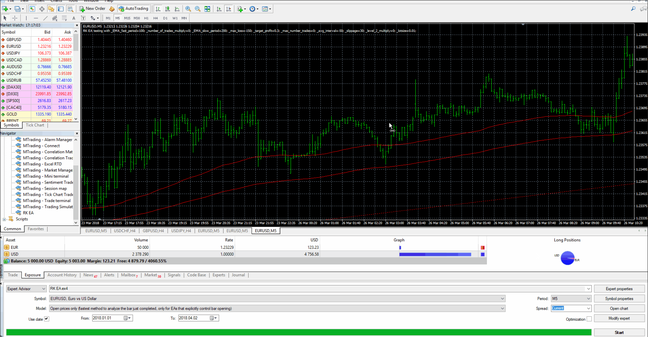

Open the strategy tester by clicking on the icon or pressing Ctrl+R. Choose the expert advisor entitled MTrading – Trading Simulator.ex4, then set your trading instrument and a time frame.

If you do not know which testing model to use specifically, choose Open Prices only. Use other settings only if you have experience.

Next, choose your preferred time window. You need to make sure that enough historical data exists for this period. Additionally, enable visual mode.

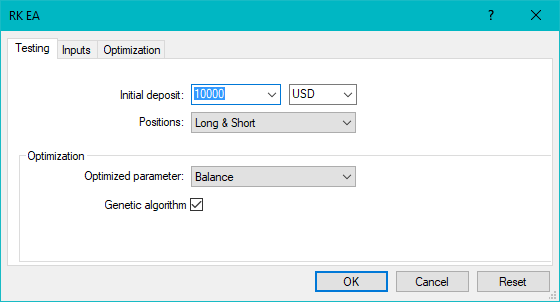

To make the simulation more authentic, adjust the initial account balance in the EA options to match your live account. You can do it by clicking Expert Properties in the MT4 simulator window, then by clicking on the Testing tab.

Source: MetaTrader4

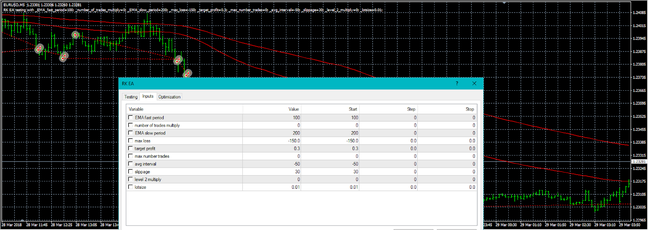

You can always change the parameters of your strategy within the EA inputs settings.

Source: MTrading Trading Simulator MT4, Custom Strategy

The key to successful paper trading

After choosing the best Forex simulator software, you should determine what goals you want to reach before moving on to a live account. Whatever you do, remember not to overtrade paper.

Many traders are having a hard time figuring out when to transition from using a demo account to a live account.

Basically, the choice is yours. Simply create your goal for transition. For example, monthly returns of at least 3%, or a profit of $1,000 for three straight months without losses.

Regardless of whether you are using Forex/CFD simulation software or a live account, don't be afraid of failing. Traders often produce losses, especially towards the beginning of their trading careers.

There are many cases of traders who failed at some point but ended up producing significant gains in some time.

For example, Jesse Livermore became famous making a fortune by shorting the stock market in 1929. However, he experienced both great success and humiliating failure during his ventures. Livermore filed for bankruptcy three times, but also became a Wall Street legend by amassing a $100 million fortune through speculative trades.

Not every trader's story is as dramatic and exciting as Livermore's. If you fear failure, you can gain experience and confidence by using a risk-free Forex trading simulation software.

Before trading FX professionally, it is crucial to gather experience – preferably, without losing money in the process.

You can do this by educating yourself on Forex trading and practising what you've learned through demo-trading. It is vital to evaluate each trade's success and, finally, repeat the process over and over again until perfection is achieved.

Stay tuned! Follow the updates in our Education section.

- How to Benefit from Short-Selling

- Trading Strategy for Asian Session on Forex

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

The Bottom Line

The main benefit of using Forex trading simulator software is zero financial risks involved. The only drawback comes with paid demo versions that users may not like. However, most brokers provide free paper trading opportunities for both beginners and pros.

Novice users can select a favorite technique while experienced traders can sharpen their strategies and bring investing methods to a new level. Make sure you opt for demo accounts with relevant spreads. Otherwise, you can overestimate current results that have nothing in common with real-life trading performance.