Introduction To Forex Technical Analysis

This is an introductory article to technical analysis on Forex. You will find out how to read it and use for your trading. Learn more about forex technical analysis signals and strategies, and master them on a free demo account by MTrading.

What Is Forex Technical Analysis?

Technical analysis refers to the process of analyzing price patterns for a given asset (or currency pair). Technical analysis is used to first identify a trend, and then second, to identify support and resistance via price charts or through certain timeframes.

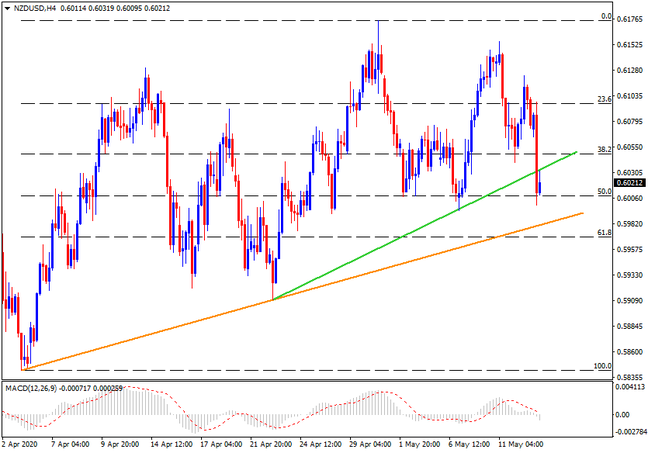

This is a screenshot illustrating technical analysis for NZD/USD currency pair, on a four-hour timeframe (H4). Follow daily technical analysis from MTrading!

There are different types of technical analysis, but the following three types are perhaps the most widely used:

Chart patterns - technical traders utilize drawing tools like Fibonacci levels, horizontal lines, and trend lines for the purpose of identifying common chart patterns (e.g. consolidation patterns, symmetrical triangle formations, and more). These patterns can then help traders to better understand the perceived 'strength' and 'weakness' of buyers and sellers within the markets.

Candle patterns - these enable traders to view the opens, closes, highs, and lows of varying trading timeframes, which is useful in terms of establishing buyer behavior within short term periods.

Indicators - forex technical traders use price action indicators in order to grasp the current state of the markets. Indicators include 'signals' which typically alert traders as to when a market has been oversold or overbought, but they can also be used to indicate shifts in momentum within the markets (in terms of price falls and rises, market volatility etc).

Read more about Forex indicators.

In addition, markets will only ever move in the following three distinct ways: up, down, or sideways. Prices tend to move in a 'zigzag' manner, and therefore, price action only has two forms:

- Range - whereby prices move sideways in a zigzag manner

- Trend - whereby prices either move upward in a zigzag manner, or downward in a zigzag manner (hence the terms: upward and downward trends)

up to 200%

from 0 pips

Trading platform

Forex Technical Analysis Basics

There are tons of different ways to use technical analysis for trading, but with all types, traders use historical information (trading patterns from the past) in order to identify potentially recognizable patterns that might be currently emerging.

From hereon, traders use the information gathered to better understand the market's current condition, as well as the best 'entry' and 'exit' points.

Whereas fundamental analysis purely focuses on analyzing news developments and economic data, and how it might have an impact on the financial markets, technical analysis follows price movement within the markets.

Price Action

The framework used for technical analysis is derived from 'Dow theory', which is the theory that 'price is an accurate indicator and reflection of all information deemed relevant'. Therefore, anything that has a drastic effect on supply & demand will likely appear on the charts.

Moreover, any information that is not related to price action is deemed as predominantly useless, since it is not possible to properly quantify this information, it is not reliable data, and it's not possible to use it.

Technical traders tend to favour 'trends' within markets, and markets can move in 'uptrends' - which are 'bullish' markets wherein the highs are higher, and the lows are lower (with big gaps between the two) and 'downtrends' - which refer to 'bearish' markets wherein the gap between the highs and lows is much smaller, and the highs and lows are much smaller in comparison to a bullish market.

There is also the 'horizontal trend' which is known as a 'ranging market'. This is an undesirable scenario for bull and bear traders alike, due to the fact that there is not any particular power shift towards either side, meaning that both sides are equal in terms of their power within the markets.

If there is a ranging market, it means that the power is not high enough on either side, and because of this, trends cannot form, since the market is moving quickly and in no particular direction.

It is estimated that markets are 'ranging' about 60% of the time, which means that forex traders have to be very focused during a trading session, in order to accurately identify trends, and then take advantage of them.

History

It is argued by the majority of technical analysts that investors/traders operate in patterns. Therefore, because there exists this idea of some perceived predictability with regards to their trading behaviour, it is therefore possible to identify potential patterns within the markets as a result.

Furthermore, by analysing information within previous historical events such as recessions, trade wars etc, traders can predict how the markets might move if a similar situation occurs in the future.

For instance, when another global recession occurs, traders could use the 2008 global recession as a point of reference, identifying any trading patterns that emerged at the time, and then comparing that with the current market data, to see if there is any correlation.

Forex Technical Analysis Signals

Simply put, signals alert traders when to perform certain actions. A 'buy' signal indicates that they should start buying a particular currency, and a 'sell' signal indicates that they should start selling a particular currency.

There are also 'false signals', which as the name suggests, refers to instances where anomalies occur, and the signal is actually incorrect and should not be acted upon. For instance, they could occur due to a lag in timing, data inaccuracies, and other types of anomalies.

Forex Technical Analysis Strategies

Technical analysis can be performed either manually by the trader, or it can be completed via automated technical analysis, wherein computer software analyses the history of price movements for currency pairs and currencies.

Probabilities

By identifying patterns and then establishing the probability of future movements, traders can essentially make 'educated guesses' as to how the market conditions will develop moving forward.

By calculating probability, traders are essentially figuring out the 'chance' of whether or not a pattern will continue, or if it is going to shift into something else. There are no certainties here, but it is a more informed strategy for trading, since it involves using data to make predictions, as opposed to simply taking risks without information to support said risks.

Combining Fundamental & Technical Analysis

Many traders these days tend to combine fundamental analysis and technical analysis, with the logic that if all the data collected through both methods is pointing to similar patterns in the markets, chances are, it's something worth taking a risk on and moving with.

Backtesting

Earlier we mentioned that technical forex traders use historical information in order to compare it with current emerging trends, and one method that traders use to do this is through forex backtesting.

Forex backtesting is also known as 'historical backtesting' and it requires the trader to input historical data into the system for the purpose of testing out a trading strategy. The key thing to remember here is that past data is not something that can provide a guarantee that a pattern or probability will last.

Stay tuned! Follow the updates in our Education section.

- How to Benefit from Short-Selling

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.