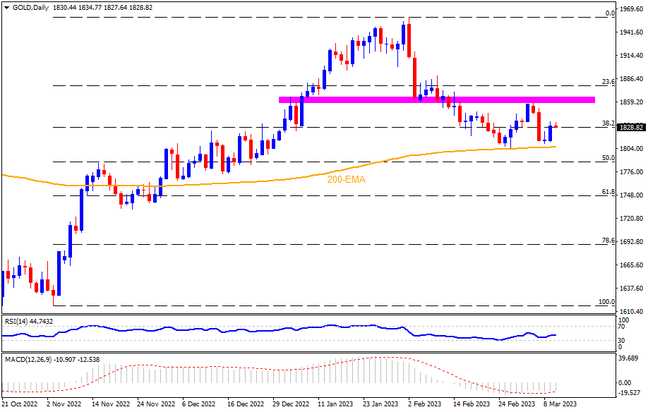

Gold stays on the bear’s radar as it reverses the previous weekly gains, the first in five, ahead of the all-important US employment report for February. It’s worth noting, however, that the 200-EMA level surrounding $1,805 puts a floor under the metal price, a break of which could set the ball rolling towards the 50% Fibonacci retracement of November 2022 to February 2023 upside, also comprising the mid-November peak surrounding $1,787. In a case where the quote remains weak past $1,787, late November’s bottom near $1,731 appears the last defense for the bulls.

On the flip side, the 38.2% Fibonacci retracement level close to $1,830 holds the key to Gold’s buyer’s entry. However, a broad nine-week-old horizontal area between $1,857 and $1,865 seems a tough nut to crack for the metal bulls. Should the bullion manages to remain firmer past $1,865, a run-up toward the $1,900 threshold becomes smooth. Following that, the multi-month high marked in February at around $1,960 could gain the buyer's attention.

Overall, the Gold price is likely to remain weak amid hawkish Fed expectations and downbeat MACD signals. However, the RSI line teases with the oversold territory and hence the quote’s further downside is likely having a little room towards the south.

Join us on FB and Telegram to stay updated on the latest market events.