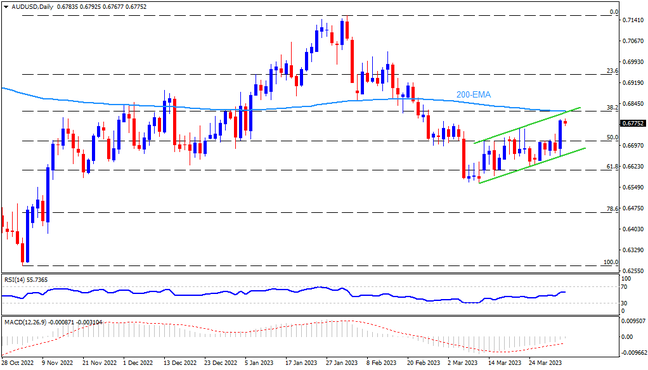

AUDUSD stays within a three-week-old bullish channel, poking the upside hurdle, on the RBA day. It’s worth noting that the 200-EMA adds strength to the top line of the state channel, around 0.6815-20 by the press time. Given the firmer oscillator, the bulls are likely to keep the reins. However, a clear upside break of the 0.6820 hurdle becomes necessary for the buyers to aim for the last December’s peak surrounding 0.6895, as well as the 0.6900 round figure. Should the quote remains firmer past 0.6900, the mid-February high of around 0.7030 can act as an intermediate halt during the likely run-up towards challenging the year 2023 peak of 0.7157.

Meanwhile, a downside break of 0.6665 defies the stated bullish channel and can quickly drag the AUDUSD bears towards challenging the monthly low of near 0.6563. In a case where the Aussie pair remains weak past 0.6560, the 78.6% Fibonacci retracement of the pair’s run-up from early November 2022 to February 2023, close to 0.6450, may act as the last defense of the buyers before giving control to the sellers.

Overall, RBA’s dovish hike should teases sellers but the Aussie pair’s trading within a bullish chart formation requires the trigger for the AUDUSD bears to retake control, which in turn highlights the 0.6665 support.

Join us on FB and Telegram to stay updated on the latest market events.