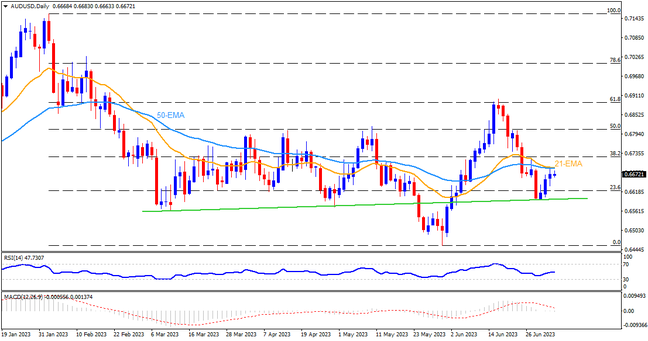

The odds of witnessing further AUDUSD upside appear dicey as a convergence of the 21-EMA and 50-EMA, around the 0.6700 round figure, challenges the bulls, together with the RBA’s inability to defend the hawkish bias. However, a three-month-old ascending support line, close to 0.6600 at the latest, limits the Aussie pair’s downside. Even if the quote drops below 0.6600, the late May swing high of around 0.6560 will test the bears before directing them to the yearly low marked in May around 0.6455.

It’s worth noting that the MACD signals seem bearish and the RSI (14) isn’t impressive enough to lure the AUDUSD buyers. If at all the RBA offers another hawkish surprise and propels the quote past the 0.6700 hurdle, the aforementioned oscillators and 38.2% Fibonacci retracement of its February-May downside, near 0.6730, will precede the 50% Fibonacci retracement level of 0.6810 to challenge the Aussie buyers. In a case where the quote remains firmer past 0.6810, the previous monthly high of near 0.6900 will act as the last defense of the bears.

Overall, AUDUSD is less likely to end up on the bull’s radar unless successfully crossing the 0.6700, as well as backed by the hawkish RBA decision.

Join us on FB and Telegram to stay updated on the latest market events.