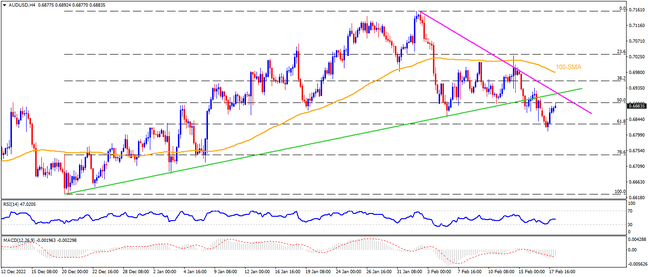

AUDUSD braces for the first monthly loss in four despite Friday’s rebound from the 61.8% Fibonacci retracement of its December 2022 to early February highs. A clear downside break of the two-month-old ascending trend line joins a two-week-old descending trend line to favor sellers. Adding strength to the bearish bias are the downbeat oscillators. The corrective bounce, however, could become important if it manages to cross the convergence of the previous support line and an immediate downward-sloping resistance line, close to 0.6950. Following that, the 100-SMA surrounding 0.6985 and the 0.7000 psychological magnet could act as the final defense of the Aussie bears before giving control to the bulls.

Alternatively, the aforementioned 61.8% Fibonacci retracement level around 0.6830, also known as the golden Fibonacci ratio, puts a floor under the short-term AUDUSD downside. Following that, the 78.6% Fibonacci ratio near 0.6750 may act as an extra filter towards the south. In a case where the Aussie pair remains bearish past 0.6750, the December 2022 low near 0.6630 could lure the sellers.

Overall, AUDUSD’s corrective bounce, if any, remains elusive unless crossing the 0.6950 hurdle.

Join us on FB and Telegram to stay updated on the latest market events.