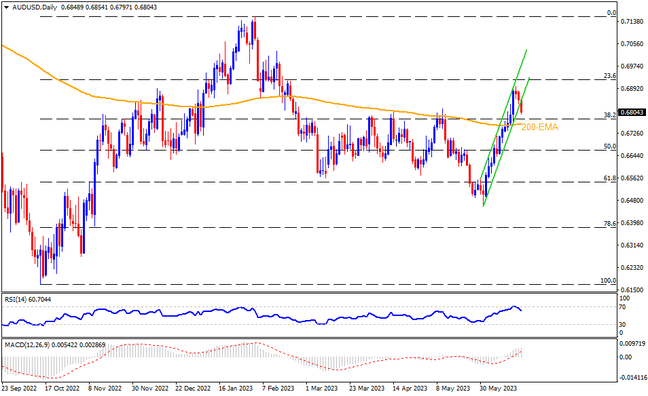

AUDUSD prods three-week uptrend after RBA Minutes and PBOC rate cut impresses bearish ahead of Fed Chair Powell’s Testimony. Also favoring the odds of a pullback in the Aussie pair is the nearly overbought RSI and concerns about hearing hawkish words from Fed Chair Powell. However, a clear downside break of a three-week-long rising trend channel becomes necessary to convince the pair bears. In doing so, a daily close below the stated channel’s bottom line, near 0.6850, becomes necessary to convince sellers. Even so, the 200-day Exponential Moving Average (EMA) level of around 0.6760 acts as the last defense of the bulls.

Meanwhile, the AUDUSD upside needs to refresh the latest monthly peak of around 0.0.6900 to convince short-term buyers. However, the stated channel’s top line, close to 0.6940, will precede the 0.7000 psychological magnet to challenge the pair’s further upside. In a case where the Aussie pair remains firmer past 0.7000, the mid-February around of around 0.7030 and the yearly high of 0.7157 will be in the spotlight.

Overall, AUDUSD bulls appear running out of steam but the bears have a long way to retake control.

Join us on FB and Telegram to stay updated on the latest market events.