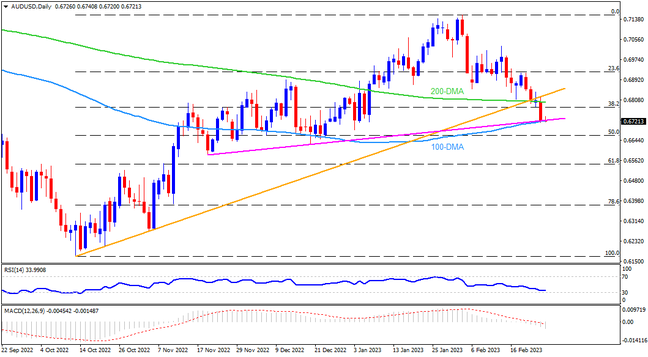

Even if sustained trading below the 100-DMA and a three-month-old ascending trend line become necessary for the AUD/USD bears, a daily closing below the 200-DMA and an upward-sloping previous support line from October 2022 signals the pair’s further decline. Further, the bearish MACD signals and downbeat RSI adds strength to the downside bias. Hence, the sellers should wait for a clear downside move below 0.6720 to aim for the lows marked in late December and November of 2022, respectively around 0.6630 and 0.6585. Following that, the 61.8% Fibonacci retracement level of the Aussie pair’s October 2022 to February 2023 upside, near 0.6550, appears the last defense of the buyers.

On the contrary, AUDUSD recovery remains elusive unless the quote stays below a convergence of the 200-DMA and four-month-old previous support, close to 0.6800. Adding to the upside filters is the December 2022 high near 0.6895 and the mid-month peak of 0.7030. In a case where the Aussie buyers keep the reins, the monthly high surrounding 0.7160 could lure the bulls.

Overall, AUDUSD is ready to witness further downside but the downturn is less likely to be smooth.

Join us on FB and Telegram to stay updated on the latest market events.