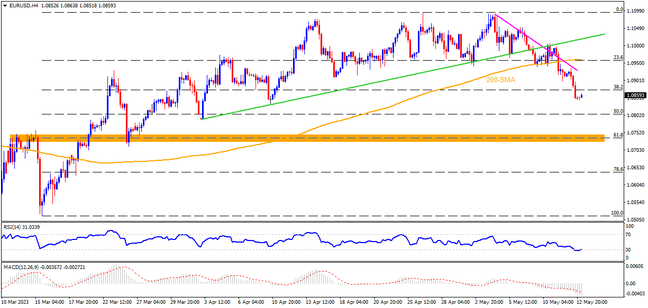

A clear downside break of 200-SMA and a six-week-old ascending trend line allowed EURUSD bears to cheer the biggest weekly loss since September 2022, not to forget the snapping of the two-week uptrend. Although the Euro bears are well-set to revisit the previous monthly low of around 1.0790, an oversold RSI may help the sellers to take a breather. As a result, a horizontal area comprising multiple levels marked since mid-March around 1.0740-30, as well as the 61.8% Fibonacci retracement level of the pair’s March-April upside, becomes crucial support to watch. In a case where the quote remains bearish past 1.0730, the odds of witnessing a fresh Year-To-Date (YTD) low, currently around 1.0480, can’t be ruled out.

Meanwhile, EURUSD recovery remains elusive unless the quote remains below a convergence of the 200-SMA and a one-week-long descending resistance line, close to 1.0960. Even so, the previous support line stretched from early April, near 1.1010 at the latest, may test the buyers before giving them control. Following that, the current yearly high marked in the last month around 1.1095 and the 1.1100 round figure will be in focus as a break of which could challenge the April 2022 peak of around 1.1185.

Overall, EURUSD is likely to witness further downside but the bears have multiple challenges and need back-up from the key EU data/events to retake control.

Join us on FB and Telegram to stay updated on the latest market events.