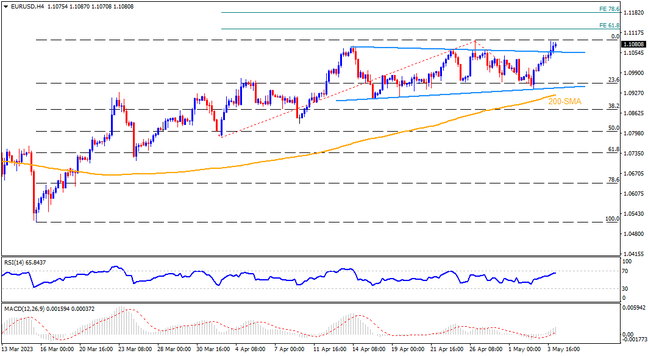

EURUSD recently pierced a three-week-old symmetrical triangle as the European Central Bank (ECB) Interest Rate Decision looms. That said, the Fed-inspired run-up impresses the Euro bulls as the pair trades successfully beyond the 200-SMA amid a firmer RSI (14) line and bullish MACD signals. As a result, the quote is well set for rising to the fresh high since late March 2022, currently around 1.1095. The same highlights the 1.1100 round figure as a lucrative stop ahead of the 61.8% Fibonacci Expansion (FE) of the pair’s moves from April 03 to May 02, near 1.1130. Following that, the 78.6% FE and March 2022 peak of around 1.1180 and 1.1185 respectively could lure the pair buyers.

Meanwhile, EURUSD sellers will need validation from the 200-SMA support of around 1.0915 to retake control. Even so, lows marked during April 10 and 03, close to 1.0830 and 1.0790 in that order, can check the bears before giving them control. In that case, the 61.8% Fibonacci retracement of the Euro pair’s March-April upside, surrounding 1.0735, may act as the last defense of the buyers before directing them to the YTD low marked in March around 1.0515.

Overall, EURUSD buyers remain in the driver’s seat as they await the key central bank decision.

Join us on FB and Telegram to stay updated on the latest market events.