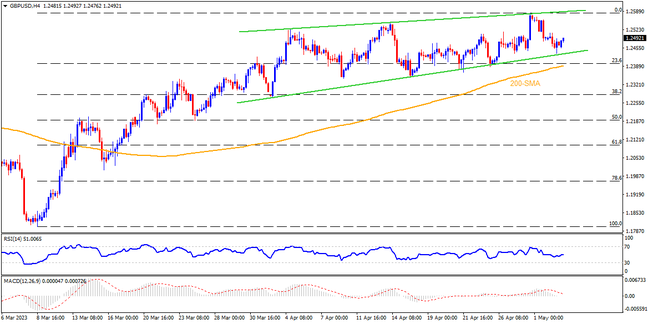

GBPUSD pauses a two-week uptrend inside a rising wedge bearish chart formation. The descending RSI (14) line, however, suggests bottom-picking and hence highlights the need for a strong downside move that can break the wedge’s lower line, as well as the 200-SMA level, respectively near 1.2430 and 1.2385. Following that, the theoretical target of rising wedge confirmation, around 1.2130, gains the market’s attention. Though the 50% Fibonacci retracement level of March-April upside near 1.2190 can act as an intermediate halt whereas the mid-March swing low around the 1.2000 psychological magnet may lure the Cable bears past 1.2130.

On the other hand, a surprise positive for the GBPUSD buyers requires successful trading beyond the latest multi-month high marked in the last week around 1.2585 to suggest the quote’s further advances. Even so, the stated wedge’s upper line near 1.2590 and the 1.2600 round figure can act as extra filters towards the north. In a case where the Cable pair remains firmer past 1.2600, the May 2022 peak of around 1.2670 and October 2020 bottom of near 1.2675 may provide the final fight to the bulls before giving them control.

Overall, GBPUSD is technically expected to witness a pullback in prices but the looming Fed and the US data can play its magic to change the scenario. Hence, Cable traders should closely observe the outcomes before taking any major positions.

Join us on FB and Telegram to stay updated on the latest market events.