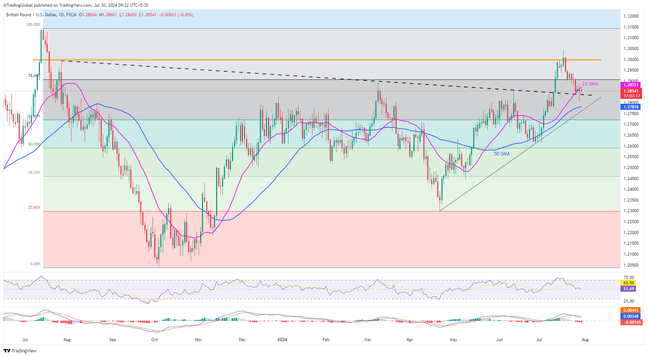

GBPUSD remains pressured after refreshing a three-week low the previous day. In doing so, the Cable pair extends the mid-week retreat from a year-long horizontal resistance while posting the first daily closing beneath the 21-SMA since July 02, 2024. Apart from that, the bearish MACD signals and the RSI line’s hovering around the 50.00 region also suggest the Pound Sterling’s further weakness. However, a previous resistance line stretched from late July 2023, close to 1.2835 at the latest, restricts the immediate downside of the quote. Following that, 50-SMA and a three-month-old ascending trend line, respectively near 1.2780 and 1.2760, will act as the final defenses of buyers before giving control to the sellers.

Meanwhile, GBPUSD buyers will need validation from the 21-SMA hurdle of 1.2872 and monetary policy announcements of the US Federal Reserve and the Bank of England (BoE). Even so, the 78.6% Fibonacci ratio of its July-October 2023 downturn and the aforementioned horizontal resistance region, close to 1.2910 and 1.3000 in that order, will be tough nuts to crack for the Pound Sterling bulls. If the Cable pair stays firmer past 1.3000, the previous yearly peak surrounding 1.3145 will be in the spotlight.

To sum up, the GBPUSD pair is likely to decline further but the road toward the south appears long and bumpy.

Join us on FB and Twitter to stay updated on the latest market events.