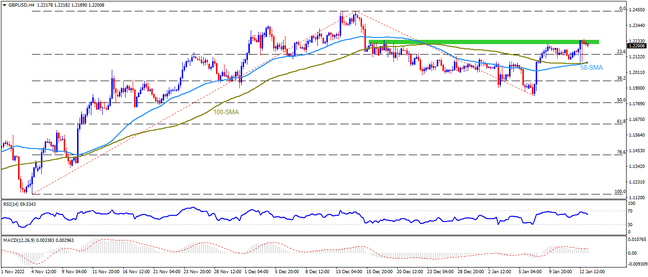

GBPUSD retreats from a one-month-old broad resistance area surrounding 1.2210-40 as the Cable traders brace for the UK data dump on Friday. The quote’s sustained trading beyond the convergence of the 50-SMA and 100-SMA, around 1.2070-65 at the latest, joins upbeat oscillators to keep the pair buyers hopeful of overcoming the key horizontal resistance zone. Following that, the previous monthly high surrounding 1.2450 could lure the bulls. It should be noted, however, that the pair’s successful trading above 1.2450 enables the bulls to aim for the 61.8% Fibonacci Expansion (FE) level of the pair’s moves between November 2022 and early January 2023, close to 1.2645.

Meanwhile, GBPUSD sellers will need a clear downside break of the aforementioned SMA confluence, near 1.2070-65, for conviction. In that case, the 1.2000 psychological magnet and the monthly low of 1.1841 should lure the bears. If at all the Cable pair remains bearish past 1.1841, a downward trajectory towards the 50% and 61.8% Fibonacci retracement level of the quote’s November-December 2022 moves, near 1.1800 and 1.1645 respectively, can be expected.

Overall, GBPUSD is likely to remain on the front foot unless the price stays beyond 1.2065 levels.

Join us on FB and Twitter to stay updated on the latest market events.