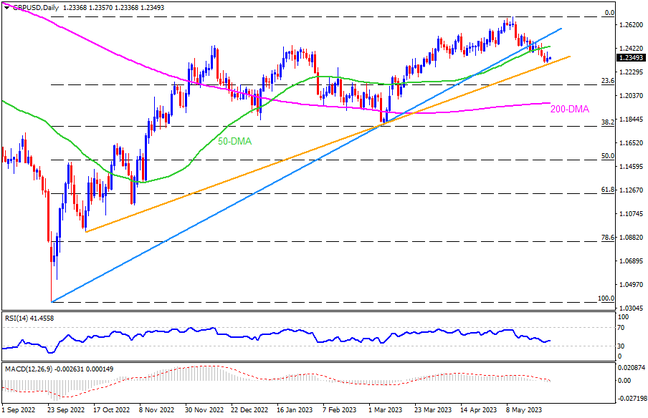

GBPUSD marked a three-week downtrend while closing below the 50-DMA, as well as an eight-month-old ascending support line. While the bearish MACD signals join the aforementioned breakdowns and favor the sellers, the RSI (14) line is below 50.00, which in turn suggests a lack of conviction at the bull’s front. As a result, an upward-sloping support line from October 2022, close to 1.2260 by the press time, becomes crucial for the sellers. Should the quote remains bearish past 1.2260, the Cable pair can fall to the 200-DMA support of around 1.1980. Following that, the current yearly low of near 1.1800 will offer the last battle to be won for the sellers before taking the throne.

On the other hand, the 50-DMA and aforementioned previous support line, respectively around 1.2435 and 1.2500, can challenge the GBPUSD pair’s latest recovery. In a case where the pair remains firmer past 1.2500, April’s high surrounding 1.2525 and the monthly peak of 1.2680 could lure the buyers. It’s worth noting that if the Pound Sterling rises past 1.2680, it will become capable of poking the 1.3000 psychological magnet.

Overall, GBPUSD is likely to return to the bear’s radar, after a two-month absence, but it needs to break the key support line to convince sellers.

May the trading luck be with you!