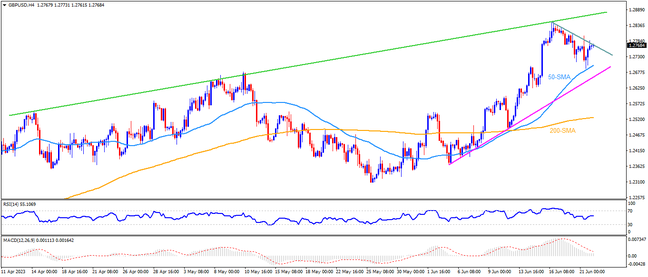

GBPUSD dropped in the last three consecutive days and is on the way to posting the first weekly loss in four as the Cable traders prepare for the Bank of England (BoE) Interest Rate Decision, despite the latest rebound. Even so, the Pound Sterling remains beyond the 50-SMA and a three-week-old rising support line, respectively near 1.2690 and 1.2655 at the latest. Even if the quote breaks these immediate supports, the monthly swing high of near 1.2540 and the 200-SMA surrounding 1.2520 can act as the last defenses.

It should be noted that the RSI is below 50.0 and suggest bottom-picking while the strong UK inflation also increases the hawkish hopes from the BoE. In that case, the weekly resistance line of near 1.2770 and the latest multi-month high marked the last week around 1.2850 will be in the spotlight. However, an upward-sloping trend line from mid-April, close to 1.2870 at the latest, will challenge the GBPUSD bulls afterward. In a case where the Cable pair remains firmer past 1.2870, multiple hurdles near 1.2970 and the 1.3000 threshold may test the upside momentum before directing the Pound Sterling prices toward the April 2022 peak of near 1.3150.

Overall, GBPUSD is likely to grind higher unless the BoE disappoints markets.

Join us on FB and Telegram to stay updated on the latest market events.