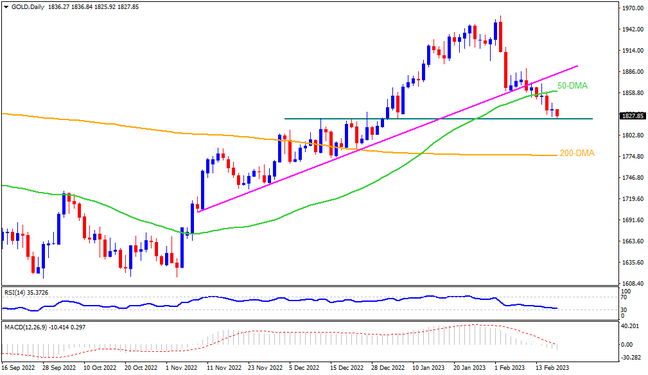

Gold extends the early February fall towards two-month-old horizontal support near $1,825-23, despite posting the indecisive closing in the last week. The bearish bias also gains strength from the clear downside break of an ascending trend line from early November and the 50-DMA, as well as the bearish MACD signals. However, the nearly oversold RSI (14) hints at the grinding of the metal prices near the stated crucial support. Should the quote drops below $1,820, early December peak near $1,810 and the $1,800 round figure may probe the gold sellers before directing them to the 200-DMA support level of around $1,775. It’s worth noting that the November 2022 high of $1,786 acts as an extra filter toward the south.

Meanwhile, the 50-DMA and the previous support line from the last November, respectively around $1,860 and $1,883, could challenge the Gold price recovery. Following that, the $1,900 round figure will be important to the metal buyers. In a case where the bullion remains firmer past $1,900, the monthly high of $1,960 and the late March 2022 top near $1,966 should challenge the run-up targeting the $2,000 psychological magnet.

Overall, Gold is likely to decline further only if it manages to break the $1,820 level.

Join us on FB and Telegram to stay updated on the latest market events.