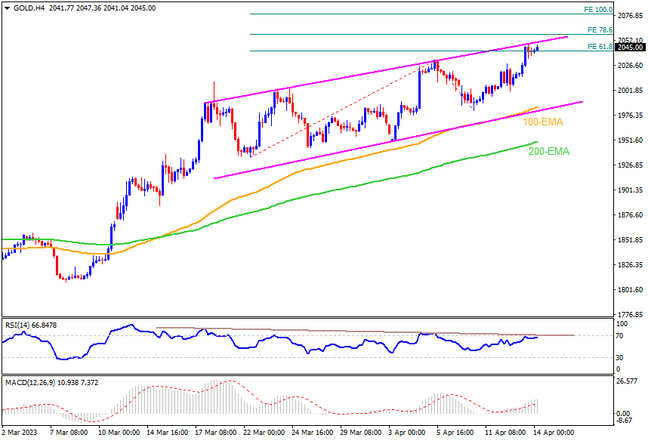

Gold price seesaws near the highest levels since March 2022 inside a one-month-old bullish channel. The bullion recently makes rounds to the upper line of the stated bullish formation amid overbought RSI (14), which in turn suggests that the buyers are running out of steam and a pullback is in the offing. The same highlights the 61.8% Fibonacci Expansion (FE) level of the metal’s moves between March 22 and April 10, around $2,041, as the immediate support. Following that, the previous weekly top surrounding $2,031 and the $2,000 round figure could lure the XAUUSD bears. It’s worth noting, however, that a convergence of the 100-EMA and the aforementioned channel’s lower line, close to $1,980-78, as the key support to watch during the quote’s further downside. Above all, the metal’s bearish trend remains elusive unless it trades beyond the 200-EMA level surrounding $1,947.

On the contrary, a successful upside break of the $2,050 defies the expectations of witnessing a pullback in the Gold price. Even so, the 78.6% FE level of around $2,057 can test the bulls before directing them to the previous yearly high of near $2,070. In a case where the bullion remains firmer past $2,070, the record high of $2,075, marked in 2020, will precede the 100% FE level of $2,078 to act as the final defense of the short-term sellers prior to propelling the quote towards the $2,100 round figure.

Overall, Gold price appears to have had enough of a run-up in the week and may witness a retreat. In doing so, the lower high on RSI and higher high of prices, known as bearish divergence, may play its role, if not the US Dollar.

Join us on FB and Telegram to stay updated on the latest market events.