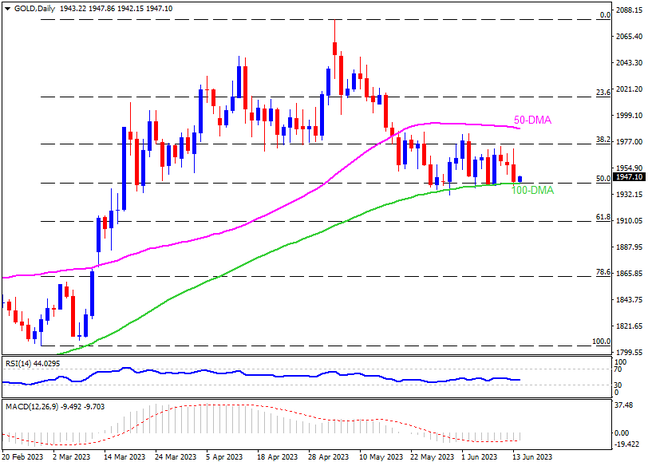

Gold again bounces off the 100-DMA after five consecutive attempts to break an important moving average that has been pushing back bears since late May. Adding strength to the said DMA support is the 50% Fibonacci retracement of its late February to May upside, near $1,940. It’s worth noting, however, that the oscillators portray a grim picture for the XAUUSD buyers and the Fed also can surprise markets, amid dovish hopes and softer US inflation. As a result, the probabilities favoring the metal’s fall to $1,914 and the $1,900 round figures are high, a break of which could recall the early March swing high of around $1,858 and the latest February lows of near $1,804 that act as the last defense of the buyers.

On the flip side, another recovery by the Gold price remains elusive unless it breaks the lower-high pattern established since late May. To do so, the bullion needs a daily close beyond the $1,984 mark. Even so, the 50-DMA hurdle of around $1,990 and the $2,000 threshold could play their roles to challenge the XAUUSD bulls. Following that, multiple levels around $2,020 and $2,050 can challenge the metal’s upside momentum before crossing the latest peak of around $2,080.

Overall, Gold buyers appear to run out of steam as the Federal Reserve Interest Rate Decision looms.

Join us on FB and Telegram to stay updated on the latest market events.