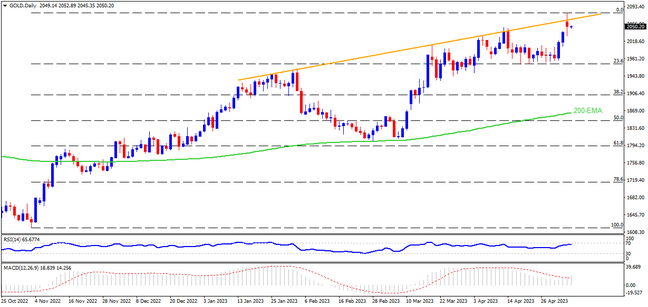

Having refreshed a multi-month high on the Federal Reserve’s (Fed) dovish rate hike, the Gold buyers appear running out of steam as markets await the US Nonfarm Payrolls (NFP) data. That said, the quote’s repeated failure to provide a daily closing beyond an upward-sloping resistance line from late January 2023, close to $2,068 by the press time, teases the XAUUSD bears. Adding strength to the hopes of a pullback is the overbought RSI line. However, the metal price needs to provide a daily close below $2,040 to facilitate the profit-booking move. In that case, the $2,000 round figure and 23.6% Fibonacci retracement level of around $1,970 could act as immediate targets ahead of February’s top surrounding $1,960. Though, the quote is less likely to drop past $1,960 as 38.2% Fibonacci retracement and 200-EMA, respectively near $1,900 and $1,863 appear tough nuts to crack for bullion sellers.

Meanwhile, the metal’s sustained trading beyond $2,040 can keep grinding its higher and mark another attempt in breaking the multi-day-old resistance line near $2,068. In that case, the highs marked in 2022 and 2020, around $2,070 and $2,075, may act as intermediate halts for the Gold buyers before directing them to the $2,100 round figures.

Overall, Gold price remains bullish but a short-term pullback seems brewing as the key US data looms.

Join us on FB and Telegram to stay updated on the latest market events.