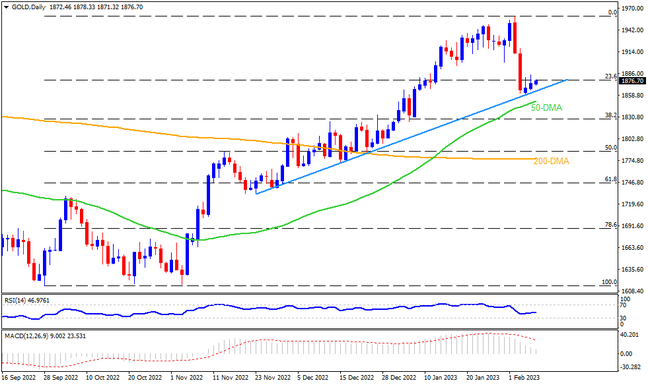

Gold bears remain unconvinced as they retreat from the key support, despite pulling back the metal from a multi-month high the last month. While the downbeat RSI conditions challenge the latest bearish momentum, MACD seems to help XAUUSD sellers as they try to break the 11-week-old support line near $1,860. It should be observed that the 50-DMA level surrounding $1,848 acts as an extra filter towards the south before directing the 38.2% Fibonacci retracement level of the bullion’s run-up from September 2022 to February 2023, near $1,827. In a case where the commodity price remains bearish past $1,827, the $1,800 round figure and the 200-DMA level near $1,776 will be in the spotlight.

Alternatively, recovery moves could aim for the $1,900 threshold to convince the Gold buyers. Following that, $1,930 and $1,945 may probe the upside momentum ahead of aiming for the latest swing top near $1,960. Should the precious metal remains firmer past $1,960, March 2022 peak surrounding $1,966 may act as a validation point for the rally targeting the $2,000 psychological magnet.

Overall, the Gold price is on the cusp of turning bearish but the sellers should wait for a clear downside break of $1,860.

Join us on FB and Twitter to stay updated on the latest market events.