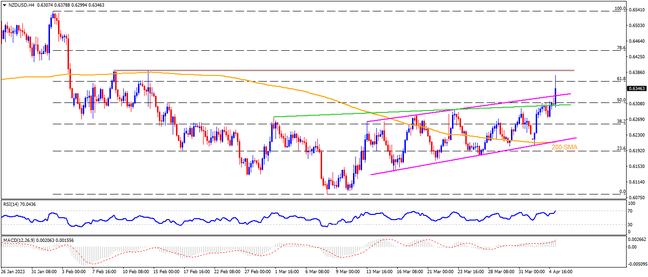

NZDUSD extends the early March’s bearish consolidation inside a three-week-old ascending trend channel as RBNZ announces the 11th consecutive rate increase. More importantly, the New Zealand central bank pleases the Kiwi bulls to renew the 7-week top by a surprise 0.50% rate hike versus the 0.25% expected. It’s worth noting, however, that the RSI conditions approach overbought territory and hence a horizontal area comprising tops marked during early February, surrounding 0.6390, appears a tough nut to crack for the NZDUSD buyers. Also acting as an upside filter is the late January swing low near 0.6415, a break of which can propel prices towards the YTD high marked in February around 0.6540.

Meanwhile, sellers need validation from the previous resistance line stretched from early March, around 0.6305, as well as the 0.6300 round figure, to retake control. Even so, a convergence of the stated channel’s bottom line and the 200-SMA, close to 0.6210, restricts the short-term NZDUSD downside. Also acting as immediate downside support is the 0.6200 round figure. In a case where the Kiwi pair remains bearish past 0.6200, the 0.6150 and 0.6130 levels mark probe the sellers before directing them to the yearly low of around 0.6085.

Overall, NZDUSD suggests the continuation of a three-week-old zig-zag run-up unless the US data surprises traders.

Join us on FB and Telegram to stay updated on the latest market events.