NZDUSD prints the biggest daily jump in more than a week, as well as snaps a two-day losing streak, on the Reserve Bank of New Zealand’s (RBNZ) hawkish halt. That said, the RBNZ held the benchmark rates unchanged, as expected, but upwardly revised the forward rate guidance. The same pushed back the rate cut and signaled expectations of a rate hike during the year. As a result, the Kiwi pair rallied to the 2.5-month high after the RBNZ announcements before retreating from 0.6152, up more than half a percent intraday by the press time.

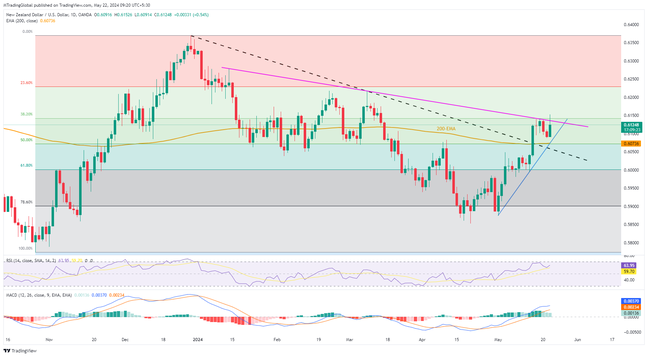

In addition to the hawkish RBNZ concerns, the NZDUSD pair’s successful trading beyond the previous resistance line stretched from late December 2023, bullish MACD signals and the upbeat RSI (14) line also keeps the buyers hopeful. However, a daily closing beyond a downward-sloping resistance line from January, near 0.6140 by the press time, becomes necessary for trading conviction. Adjacent to the 0.6140 hurdle is the previous weekly high and 38.2% Fibonacci retracement of the quote’s late 2023 upside, near 0.6145. Hence, the bulls need validation from 0.6140-45 to keep the reins. Following that, the double tops marked in February and March around 0.6220 and 23.6% Fibonacci ratio near 0.6230, followed by the 0.6280-85 resistance region, will become the upside targets.

On the contrary, a convergence of the 200-bar Exponential Moving Average (EMA) and a three-week-old rising trend line, around 0.6075-70 at the latest, restricts the NZDUSD pair’s short-term downside ahead of the previously stated resistance-turned-support line near 0.6060. In a case where the Kiwi pair remains bearish past 0.6060, the 61.8% Fibonacci retracement level near the 0.6000 threshold, will act as the final defense of the bears before directing the prices toward the yearly low of near 0.5850.

Overall, the Kiwi pair is likely to remain firmer unless declining back beneath the 0.6060 level. However, fresh buying should wait for a clear upside break of 0.6145.

Join us on FB and Telegram to stay updated on the latest market events.