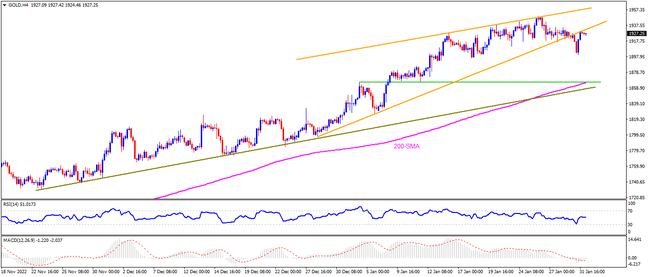

After pleasing buyers for six consecutive weeks, Gold prices are finally on the bear’s radar even after bouncing off $1,900 round figure the previous day. The rising wedge confirmation and bearish MACD signals do favor the metal sellers ahead of the key event. However, the downbeat RSI and a likely dovish rate hike challenge the downside bias. That said, a horizontal area comprising the early month levels surrounding $1,865 appears as the immediate target during the metal’s further declines. Though, the 200-SMA and an upward-sloping support line from late November 2022, respectively near $1,862 and $1,855 could please the metal sellers during the theoretical target surrounding $1,825.

Meanwhile, Gold’s recovery remains unconvincing below the stated wedge’s lower line, around $1,928 at the latest. Even so, the monthly high near $1,950 and the bearish formation’s top line, close to $1,960, might challenge the quote’s further advances. Additionally acting as an upside filter is the late March 2022 peak surrounding $1,966. In a case where the bullion stays firmer past $1,966, the odds of witnessing a rally towards the April 2022 high near $1,998 and then to the $2,000 psychological magnet can’t be ruled out.

To sum up, Gold is ready to pare the recent rally but it all depends upon how well the Fed manages to entertain the Dollar bulls.

Join us on FB and Twitter to stay updated on the latest market events.