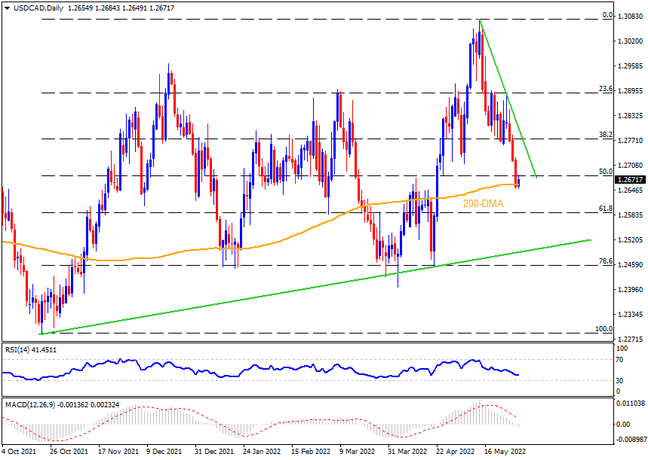

USDCAD bears keep reins around a five-week low, attacking the 200-DMA ahead of the key Canada Q1 GDP. Given the likelihood of a softer growth number, as well as considering nearly oversold RSI, the Loonie pair may rebound from the stated moving average surrounding 1.2660. In a case where the quote refrains from respecting the RSI and the DMA, the 61.8% Fibonacci retracement of October 2021 to May 2022 upside and an upward sloping support line from late 2021, respectively near 1.2585 and 1.2500, will be important to watch during the additional south-run.

Meanwhile, recovery moves may initially aim for the 1.2700 threshold and then the 1.2760 hurdle before challenging a 13-day-long resistance line surrounding the 1.2800 round figure. It’s worth noting that the USDCAD pair’s run-up beyond 1.2800 won’t hesitate to challenge March’s high of 1.2900 and December 2021 peak close to 1.2965.

To sum up, USDCAD bears battle with the key support and may retreat a bit should the scheduled data disappoint.

Join us on FB and Twitter to stay updated on the latest market events.