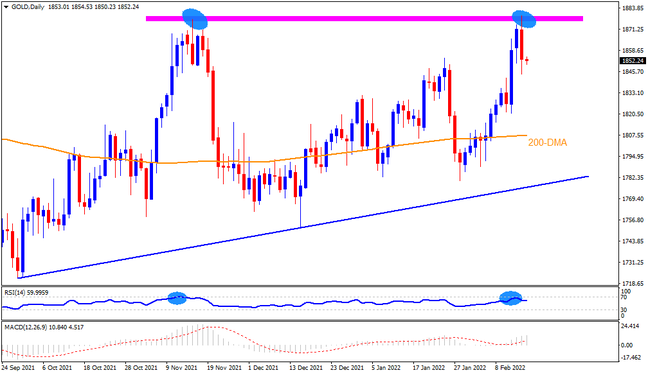

Gold marked a stellar decline after refreshing eight-month top on Tuesday, forming a double top around $1,880. Not only the bearish chart pattern but RSI divergence also warrants the buyer’s caution as the higher high in prices accompanies lower-high of the RSI line. Hence, odds of a pullback towards the 200-DMA level of $1,807 can’t be ruled out if the quote drops below January’s top near $1,853. It should be noted, however, that the metal’s weakness below $1,807 will be challenged by an ascending support line from September, close to $1,777.

Meanwhile, a sustained run-up beyond the $1,880 hurdle will reject the RSI divergence and the bearish chart signals, which in turn will propel the quote towards the $1,900 threshold. Though tops marked during June and January 2021, around $1,916 and $1,960 in that order, will challenge the gold buyers if they keep reins past $1,900. In a case where the yellow metal rises past $1,960, the $2,000 psychological magnet should return to the charts.

Fundamentally, today’s FOMC Minutes may also offer pullback moves of gold should the statement brighten the scope of a 0.50% rate hike in March.

Join us on FB and Twitter to stay updated on the latest market events.