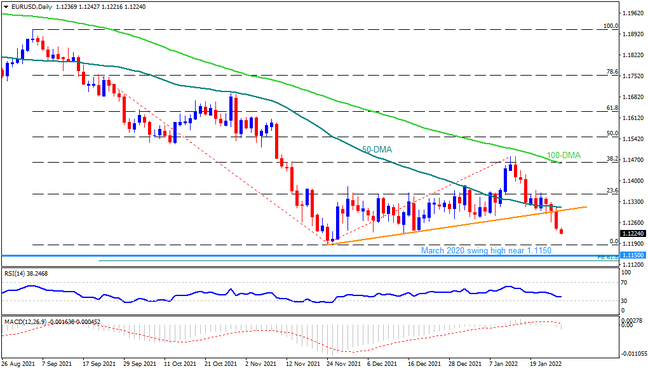

EURUSD bears cheer a clear downside break of a two-month-old ascending trend line, as well as sustained trading below 50-DMA, to brace for 2021 bottom surrounding 1.1185. The MACD and RSI both support the bearish bias. However, the pair’s declines past 1.1185 have a bumpy road as March 2020 swing high near 1.1150 and 61.8% Fibonacci Expansion (FE) of late September 2021 to January 2022 moves around 1.1120 will challenge the sellers afterward. It’s worth noting that the RSI conditions also inch closer to the oversold territory and hence a move past 1.1185 will push it to signal a bounce before further south-run.

Alternatively, the aforementioned support-turned-resistance line near 1.1295 precedes the 50-DMA level of 1.1315 to restrict short-term EURUSD rebound. Following that, the 23.6% Fibonacci retracement (Fibo.) of September-November 2021 declines, close to 1.1360, will gain the market’s attention. It’s worth noting, however, that the pair’s upside beyond 1.1360 will be challenged by the 1.1460-65 resistance confluence, comprising 100-DMA and 38.2% Fibo.

To sum up, EURUSD has already flagged downside signals towards 2021 bottom but any further weakness becomes doubtful.

Join us on FB and Twitter to stay updated on the latest market events.