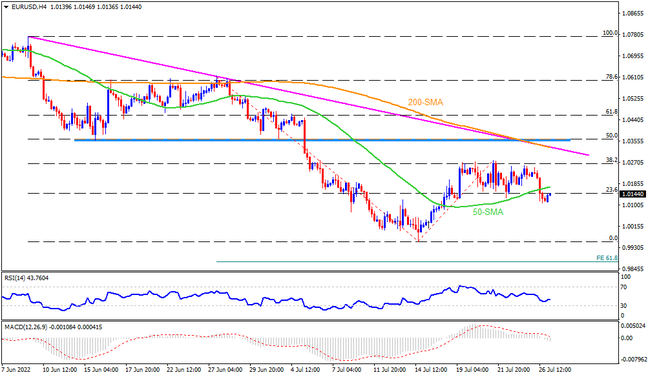

EURUSD remains pressured around a one-week low as traders prepared for the Fed’s verdict, likely a 0.75% rate hike and Powell’s aggression. That said, the pair’s clear downside break of the 50-SMA directs the quote toward the multi-year low marked earlier in the month around 0.9950. Given the RSI approaches the oversold territory, the pair’s declines past 0.9950 appears less expected. However, the bear’s rejection to step back from 0.9950 could open the doors for the further south-run towards the 61.8% Fibonacci Expansion (FE) of June 27 to July 21 moves, around 0.9870.

Meanwhile, recovery remains elusive below the 50-SMA level surrounding 1.0165. Following that the previous weekly top around 1.0275 could gain the EURUSD buyers’ attention. However, a convergence of the 200-SMA and downward sloping resistance line from early June, close to 1.0340, should challenge the bulls. Also acting as the key upside hurdle is the six-week-old horizontal area near 1.0360-65.

Overall, EURUSD is likely to decline further towards refreshing the yearly bottom. However, it all depends upon the Fed’s actions. Hence, the trader’s discretion is required.

Join us on FB and Twitter to stay updated on the latest market events.