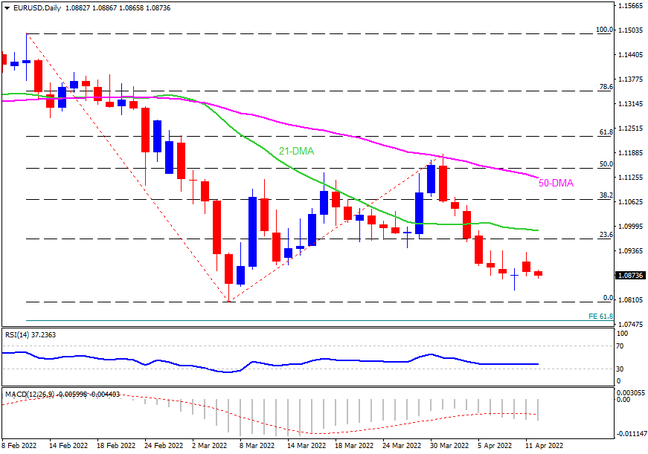

EURUSD fades Friday’s rebound ahead of the key US Consumer Price Index (CPI) data for March. Steady RSI and bearish MACD signals also support the bearish bias. That said, the 1.0845-35 region offers immediate support to the currency major ahead of directing it to the latest multi-month low surrounding the 1.0800 threshold. In a case where EURUSD bears remain dominant past 1.0800, the 61.8% Fibonacci Expansion (FE) of February-March moves, near 1.0755, will be in focus.

On the flip side, 23.6% Fibonacci Retracement (Fibo.) and 21-DMA, respectively around 1.0970 and 1.0990, restrict the short-term recovery of the EURUSD pair. However, bulls remain cautious until the quote stays below the 50-DMA level of 1.1125. Also acting as an upside filter is the previous month’s peak around 1.1185. It’s worth noting that the pair’s successful trading above 1.1185 enables the buyers to retake control.

Overall, US inflation data is likely to exert downside pressure on the EURUSD prices.

Join us on FB and Twitter to stay updated on the latest market events.