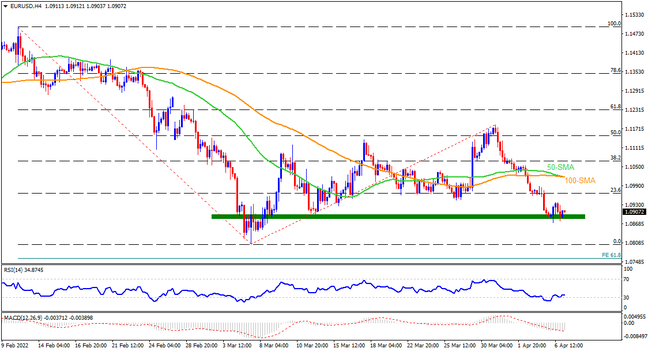

A one-month-old horizontal area probes EURUSD bears amid oversold RSI conditions, portraying a corrective pullback towards the late March low near 1.0945. However, a convergence of the 50-SMA and 100-SMA, as well as bearish MACD signals, can challenge sellers afterward. In a case where the SMA confluence fails to stop buyers, 1.1120 and the last monthly peak surrounding 1.1185 will act as validation points before giving reins to the bulls.

On the contrary, fresh selling should wait for a clear downside break of the aforementioned horizontal support around 1.0885-80. Following that, the yearly low near 1.0800 will be quick to return to the charts. Though, the 61.8% FE of February-March moves near 1.0760 could test the EURUSD bears afterward. If at all the pair refrains from bouncing off the 61.8% FE level, the year 2020 bottom surrounding 1.0635 will be in focus.

Join us on FB and Twitter to stay updated on the latest market events.