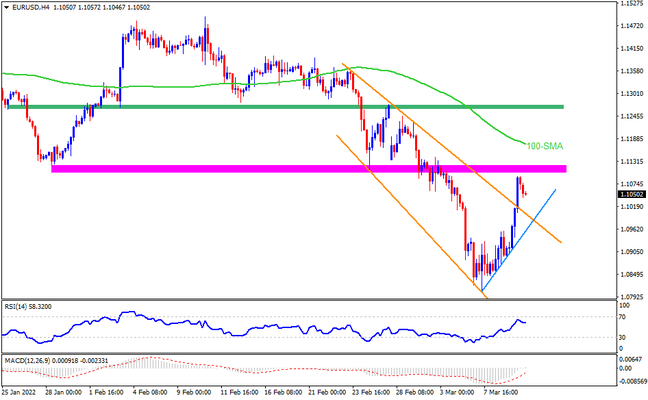

EURUSD extends the early week rebound from a 22-month low, also holding the previous day’s break of a bearish broadening pattern as traders brace for the European Central Bank (ECB) monetary policy meeting. Given the recently improving MACD and RSI, the pair’s recovery moves are likely heading towards a six-week-old horizontal area between 1.1100 and 1.1125. However, the 100-SMA and multiple levels marked since January 25, respectively around 1.1190 and 1.1270, will challenge the pair buyers.

Meanwhile, the resistance-turned-support line of the stated megaphone pattern, around 1.1015 at the last, will direct EURUSD towards a three-day-old ascending support line, close to 1.0920. In a case where the pair sellers conquer the immediate support, the latest multi-month low near 1.0800 and April 2020 bottom surrounding 1.0725 could flash on their radars. It should be noted, however, that the bears will have a tough time breaking the 1.0700 level, comprising the lower line of the megaphone and may bounce from the same should the fundamentals support.

To sum, ECB is widely anticipated to keep the current monetary policy unchanged and may accept the fear of stagflation, mainly due to the Russia-Ukraine tussles. However, any positive surprises may trigger the short-covering moves as the quote trades near the multi-month low.

Join us on FB and Twitter to stay updated on the latest market events.