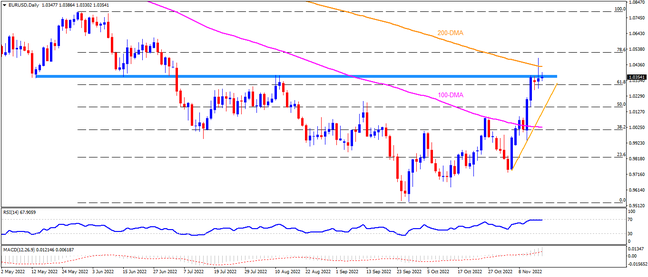

EURUSD refreshed a 4.5-month high by piercing the 200-DMA ahead of the US Retail Sales. Even so, a successful break of the stated key moving average level, around 1.0430 by the press time, appears necessary for the bulls to keep the reins, in addition to the downbeat US data. Following that, the 78.6% Fibonacci retracement level of May-September declines, near 1.0520, could act as an additional upside filter before directing buyers towards the late June high near 1.0615. In a case where the pair remains firmer past 1.0615, the odds of crossing the mid-2022 peak surrounding 1.0785 can’t be ruled out.

Meanwhile, EURUSD’s failure to provide a daily closing below 1.0430 could trigger a pullback towards a six-month-old horizontal support area near 1.0370-50. Should the pair breaks the multi-day-old support region, the 61.8% Fibonacci retracement level and September’s high, respectively near 1.0300 and 1.0195, could test the bears. It’s worth noting that a one-week-old support line and the 100-DMA, close to 1.0065 and 1.0025 in that order, are likely the last defenses for the pair buyers, a break of which will highlight the yearly low.

Overall, EURUSD buyers remain in the driver’s seat but the further upside hinges on a 1.0430 breakout, as well as the US data.

Join us on FB and Twitter to stay updated on the latest market events.