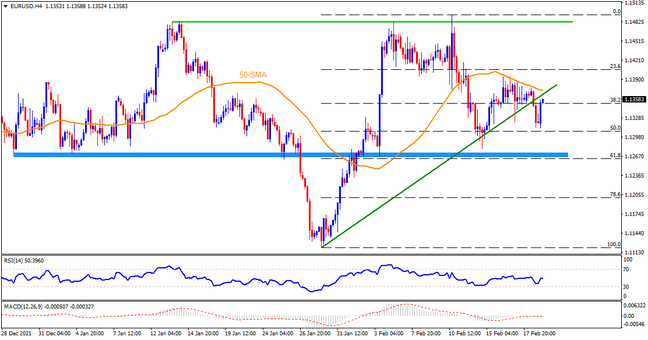

EURUSD keeps pullback from 50-SMA to kick-starts the key week comprising preliminary PMIs for February, as well as the second readings of US Q4 GDP. Recently keeping sellers hopeful is Friday’s downside break of a short-term support line, now resistance around 1.1335. Despite the latest corrective pullback, the below 50 RSI and bearish MACD signals, the quote is likely to extend the latest fall towards a horizontal area from late December, surrounding 1.1270. However, the 78.6% Fibonacci retracement of January-February upside will challenge the quote’s further downside around 1.1200, a break of which won’t hesitate to direct the bears towards the previous month’s low of 1.1120.

On the contrary, the support-turned-resistance line and the 50-SMA, respectively around 1.1335 and 1.1375, guard the EURUSD pair’s short-term recovery moves. During the pair’s recovery past-1.1375, the 1.1400 threshold will act as a last defense for the sellers. Should the quote remain firmer beyond 1.1400, the monthly high surrounding 1.1495 and the 1.1500 round figure will probe the bulls.

Overall, a sustained trading below the short-term important moving average and a trend line break favor EURUSD sellers.

Join us on FB and Twitter to stay updated on the latest market events.