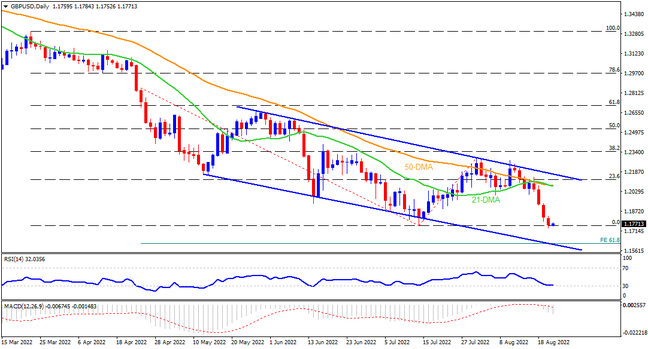

GBPUSD dropped consecutively during the last four days to approach the yearly low marked in July, before recently bouncing off towards 1.1800. The bears, however, appear more dreadful this time as the RSI has comparatively more space to hit the oversold territory than the previous south-run to refresh the multi-day low of 1.1760. That said, the 1.1760 level may test the sellers before directing them to a convergence of the three-month-old descending trend channel and 61.8% Fibonacci Expansion (FE) of April 25 to August 01 moves, around 1.1620. Should the quote fail to reverse from the 1.1620 support confluence, the March 2020 lows near 1.1410 will gain the market’s attention.

Alternatively, recovery moves remain elusive until the quote rises back beyond June’s low of 1.1935. Following that, the 1.2000 psychological magnet could lure the buyers. It should be noted, however, that the GBPUSD run-up beyond 1.2000 will challenge the convergence of the 21 DMA and 50 DMA, around 1.2080-85, which will be crucial to watch for a short-term trend change.

To sum up, GBPUSD is on the bear’s radar for a fresh yearly low as traders brace for the flash PMIs for August.

Join us on FB and Twitter to stay updated on the latest market events.