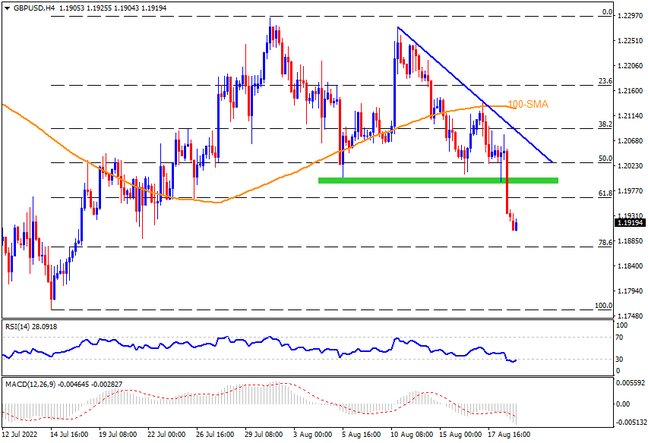

GBPUSD extended pullback from 100-SMA to refresh monthly low, before the recent corrective pullback near 1.1900. In doing so, the Cable pair also broke below the support area of a fortnight-old descending triangle. The downside break also takes clues from the bearish MACD signals, suggesting more to run towards the south. However, the late July swing low around 1.1890 will be in focus as the RSI quickly approaches the oversold territory and teases a bounce. Should the price remain weak past 1.1890, the yearly low marked in the last month, close to 1.1760 should lure the sellers.

Alternatively, recovery moves could initially aim for the triangle’s upper line, at 1.2080 by the press time, a break of which could escalate the direct buyers towards the 100-SMA level surrounding 1.2130. It’s worth noting that multiple hurdles around 1.2200 could challenge the GBPUSD buyers afterward. Should the quote remain firmer past 1.2200, the odds of its refreshing the monthly top, close to 1.2190 at the latest can’t be ruled out.

Overall, GBPUSD bears keep the reins but oversold RSI suggests limited room to the south.

Join us on FB and Twitter to stay updated on the latest market events.