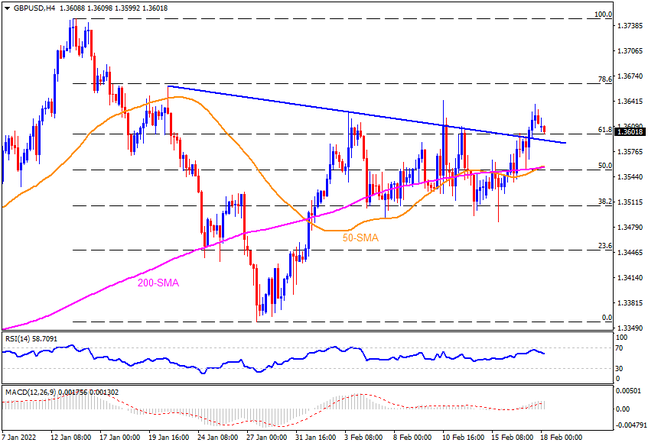

GBPUSD stays beyond a downward sloping resistance line from January 20, now support around 1.3590. Despite the recent pullback, the trend line breakout joins upbeat RSI and MACD signals to direct buyers towards the late January tops surrounding 1.3660. Following that, January 14 swing low near 1.3700 will gain the market’s attention as the RSI might have turned overbought by then. If not then the last month’s peak of 1.3748 should return to the charts.

Alternatively, pullback moves remain elusive beyond the resistance-turned-support line, close to 1.3590. Though, a convergence of the 50-SMA, 200-SMA and 50% Fibonacci retracement (Fibo.) of January 2022 downside, around 1.3550, becomes a tough nut to crack for the GBPUSD bears. Should the pair drop below 1.3550, it becomes vulnerable to drop towards the 38.2% and 23.6% Fibo. levels, respectively around 1.3500 and 1.3450.

To sum up, a clear upside break of the previous key resistance line joins successful trading beyond the 1.35550 support confluence to favor GBPUSD buyers.

Join us on FB and Twitter to stay updated on the latest market events.