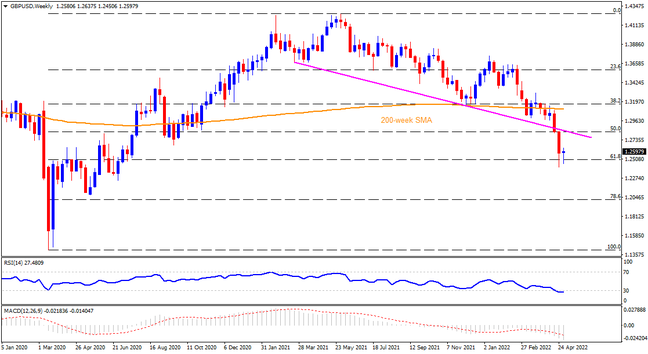

GBPUSD stays near the two-year low, despite the post-Fed rebound, as cable traders brace for the Bank of England’s (BOE) 0.25% rate hike. Given the latest hawkish moves from the RBA and the Fed, the “Old Lady’s” heavier-than-expected measures to tame inflation won’t be a surprise. In that case, the pair will witness the much-awaited rebound from the 61.8% Fibonacci retracement (Fibo.) of March 2020 to May 2021 upside towards September 2020 bottom surrounding 1.2675. However, a convergence of the previous support line from March 2021 and 50% Fibo, around 1.2830, appears a tough nut to crack for the pair buyers, a break of which could escalate the recovery moves towards the 200-week SMA surrounding 1.3100.

Alternatively, a disappointment from the BOE will need a clear break of the aforementioned key Fibo support level, near 1.2500, to direct bears towards the June 2020 bottom of 1.2250. In a case where GBPUSD prices remain weak past 1.2250, the May 2020 swing low around 1.2075 will act as the last defense for the buyers as a break of which won’t hesitate to call the 2020’s yearly trough of 1.1409.

To sum up, GBPUSD remains in the hands of bears ahead of the BOE’s monetary policy decision.

Join us on FB and Twitter to stay updated on the latest market events.