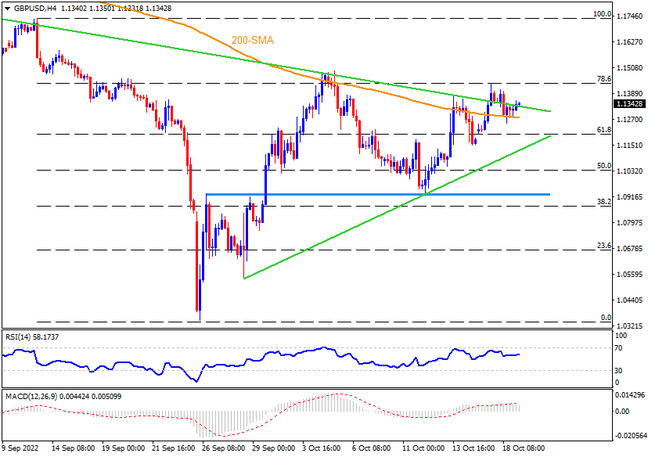

GBPUSD seesaws around a monthly resistance line, after successfully crossing the 200-SMA, as buyers await the UK inflation data. In addition to the stated trend line hurdle surrounding 1.1330, the 78.6% Fibonacci retracement level of September 13-26 downside, near 1.1435 and the monthly peak of 1.1495 could challenge the quote’s further upside. It’s worth noting that the pair’s sustained run-up beyond the 78.6% Fibonacci retracement level will need validation from the 1.1500 round figure to give control to buyers. Following that, a rally towards crossing the previous monthly top around 1.1740 can’t be ruled out.

Meanwhile, pullback moves are unimportant beyond the 200-SMA level surrounding 1.1280. In a case GBPUSD drops back below the key SMA support, an upward-sloping support line form stretched from September 28, close to 1.1110, will be important to watch. Additionally, a three-week-old horizontal area near 1.0930-20 appears a last defense of the Cable buyers, a break of which could quickly direct the quote towards the 23.6% Fibonacci retracement level of 1.0670 and the September 29 swing low around 1.0540 before highlighting the all-time bottom of 1.0345 flashed the last month.

Overall, GBPUSD tries to convince buyers but the road to the north is a long and bumpy.

Join us on FB and Twitter to stay updated on the latest market events.