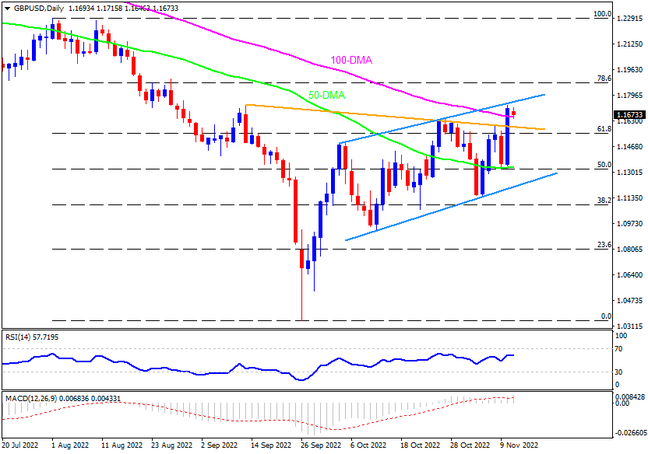

GBPUSD’s rally post-US inflation data enabled it to poke the 100-DMA for the first time since late February. The pair’s further upside, however, appears limited as bulls brace for the UK’s Q3 GDP amid fears of witnessing a clear sign of recession. That said, the 100-DMA hurdle of 1.1665 and the upper line of a five-week-old bullish channel’s resistance line, near 1.1750, could challenge the quote’s immediate advances. Following that, the 78.6% Fibonacci retracement level of August-September downside and the early August low, respectively near 1.1875 and 1.2000, could entertain the buyers.

Meanwhile, pullback moves need a daily closing below the two-month-old resistance line, close to 1.1585 at the latest, to tease GBPUSD sellers. Even so, a convergence of the 50-DMA and 50% Fibonacci retracement level near 1.1330 will be a tough nut to crack for the bears. It’s worth observing that the previously stated bullish channel’s lower line, near 1.1210, appears the last defense of the buyers, a break of which won’t hesitate to challenge October’s low surrounding 1.0950.

Overall, GBPUSD is on the bull’s radar ahead of the key UK GDP data. However, the quote’s further upside appears limited.

Join us on FB and Twitter to stay updated on the latest market events.