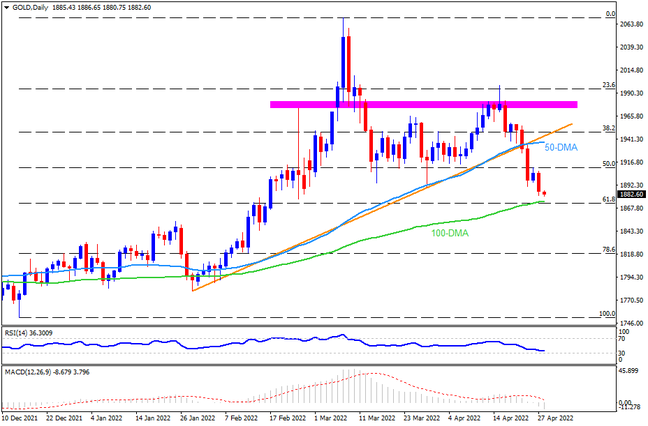

Gold sellers cheer firmer US dollar and a sustained break of the three-month-old ascending trend line at the lowest levels in nine weeks ahead of the key US Q1 2022 GDP data. However, a convergence of the 100-DMA and 61.8% Fibonacci retracement (Fibo.) level of December 2021 to March 2022 upside, surrounding $1,875, appears a tough nut to crack for the metal bears. Also acting as a downside filter is January’s high of $1,853 and 78.6% Fibo. level near $1,819, a break of which will make the bullion vulnerable to drop towards the sub-$1,800 region.

On the flip side, recovery remains elusive below the 50% Fibonacci retracement level around $1,910. Following that, the 50-DMA and previous support line will challenge the gold buyers at around $1,938 and $1,943 respectively. Even if the metal prices rally beyond $1,943, a two-month-old horizontal area between $1,975 and $1,982 will be a tough challenge.

Overall, gold bears have the controls but need validation from strong support to dominate further.

Join us on FB and Twitter to stay updated on the latest market events.