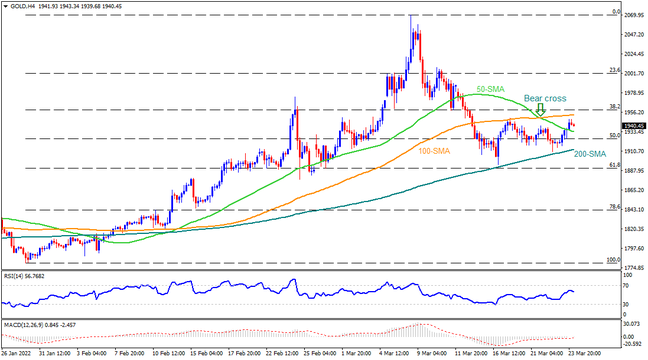

Be it the March PMIs or US Durable Goods Orders, not to forget the key NATO meeting, Thursday has it all to trigger market volatility. Gold has already printed a bear cross but the 200-SMA has been defending bulls so far, suggesting a tough fight between the buyers and sellers. However, lower-high formation since the early days of March, as well as sluggish MACD and gradually picking up RSI, keeps sellers hopeful of witnessing a break of the 200-SMA support, around $1,910. Following that, the monthly low and late February’s bottom, respectively around $1,895 and $1,878, will act as validation points for the bear’s entry.

On the contrary, a clear upside break of the 100-SMA level surrounding $1,955 will escalate the gold prices towards the previous month’s peak near $1,975. Though, the $2,000 threshold and 23.6% Fibonacci retracement of January-March upside around $2,002 will challenge the metal buyers. In a case where the bullion prices remain firm past $2,002, the quote can confront the $2,040 hurdle with hopes of challenging the monthly peak of $2,071.

To sum up, gold sellers slowly grip the prices ahead of the key data/events but it all depends more on fundamentals, making it necessary for traders to remain cautious.

Join us on FB and Twitter to stay updated on the latest market events.