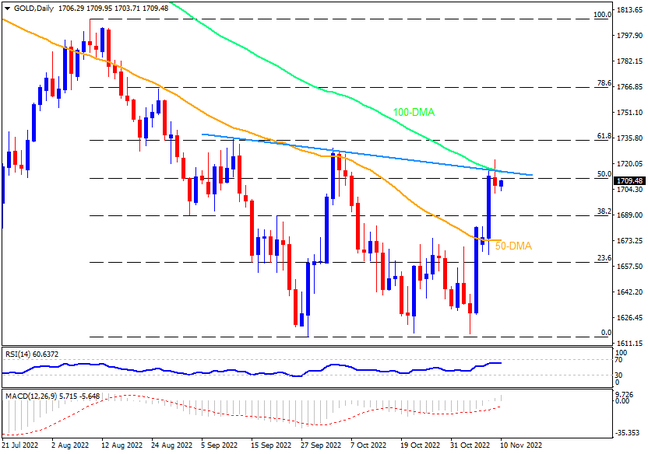

Gold prices are so far up for the second consecutive week as traders await the key US inflation data. In addition to the CPI print, the metal’s further upside also hinges on a convergence of the 100-DMA and a two-month-old descending trend line, surrounding $1,716. A clear break of $1,716 could enable the bulls to aim for the 61.8% Fibonacci retracement level of August-September downside, near $1,735. It is worth noting, however, that the late August swing high of around $1,765 could challenge the bullion buyers past $1,735 while any further upside won’t hesitate to challenge the August month’s high near $1,808.

Alternatively, strong US inflation data and a sustained pullback from the $1,716 resistance confluence will need validation from the $1,700 threshold to convince gold bears. Following that, the 50-DMA level surrounding $1,672 could act as the last defense of buyers. In a case where the gold remains bearish past the 50-DMA breakdown, $1,630, $1,620 and the yearly low near $1,614 could offer intermediate halts before highlighting the $1,600 round figure on the chart.

Overall, gold is likely to witness further upside but it all depends upon the US data, as well as the $1,720 breakout.

Join us on FB and Twitter to stay updated on the latest market events.